Allergy & Immunology

Learn More

The pace of biopharma development is constantly accelerating. Novel technologies transform the way we discover, develop, and commercialize medicines while the bar has never been higher to demonstrate safety, efficacy, and value. At Health Advances, we combine our unique breadth of experience with depth of therapeutic area knowledge to help you make successful business decisions and stay ahead on the high-stakes path of drug development.

s of your platforms and programs

s of your platforms and programsOur teams regularly tackle the toughest strategic questions facing biopharma companies at the corporate, franchise, and asset levels.

For clients that range from early-stage startups to the largest pharmaceutical companies, we serve as trusted advisors to identify avenues for corporate growth. We provide:

Our strategies are rooted in a strong fundamental understanding of biopharma assets. For individual programs we offer a comprehensive range of solutions:

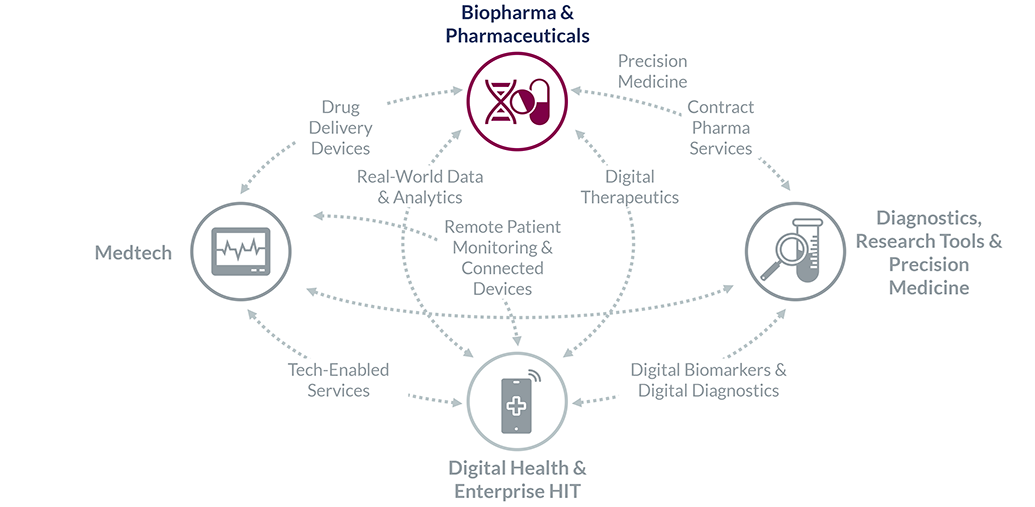

Finally, we are uniquely positioned in areas of convergence, where deep expertise in other sectors is a must:

The following practices are fields in which we have dedicated Partners and Vice Presidents with longstanding experience, teams with up-to-date expertise, specialized internal resources curated from years of casework, and an expert network of key opinion leaders and decision-makers. This enables us to add value from day one, become a natural extension of your team, and drive decisions forward.

Learn More

Learn More

Learn More

Learn More

Learn More

Learn More

Learn More

Learn More

Learn More

Learn More

Learn More

Learn More

Learn More

Learn More

Learn More

Learn More

Vivek Mittal, PhD

Partner and Managing Director, Head of Biopharma

Biotech & Pharmaceuticals InvestorsAllergy & Immunology, CNS Diseases, Cardiovascular, Cell & Gene Therapy, Oncology

Sheela Hegde

Managing Partner and Global Head

Biotech & Pharmaceuticals InvestorsAllergy & Immunology, Cardiovascular, Diabetes & Metabolics, Drug Delivery Devices

Balazs Felcsuti

Partner

Biotech & Pharmaceuticals InvestorsAllergy & Immunology, Cardiovascular, Contract Pharma Services, Diabetes & Metabolics

Kelly Cockerill

Vice President, Strategy and Business Development

Biotech & Pharmaceuticals Investors