Blog | 10/8/2021

Building and Defending Markets; Reflections on Attending DTx and NASS Conferences

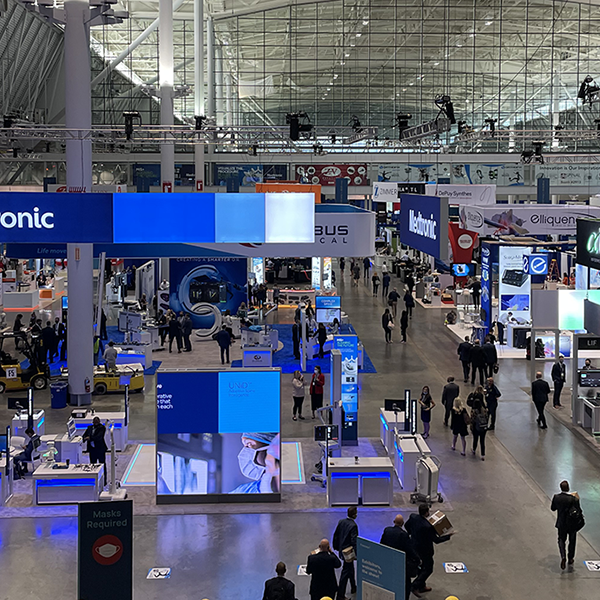

This week I attended the Digital Therapeutics (DTx) East and North American Spine Society (NASS) conferences in Boston. While simply exciting to be out of the house and interacting with people, the conferences were also a fascinating contrast to observe. On one hand, we had the 4th annual DTx East, a new(-ish) conference for an array of digital therapeutics companies. On the other, NASS, the 36th annual, largest spine surgery conference in the world with massive MSK players touting their latest implants, instrumentation, and computer-assisted surgical solutions (e.g., robotics, navigation, augmented reality).

Two Industries on Opposite Ends of Market Maturity

What Can Digital Therapeutics and Musculoskeletal Players Learn from Each Other?

Across both conferences, similarities existed as well. The fundamental question all companies are struggling with is: How do we tackle the many challenges our industry is facing and simultaneously create value for ourselves and our beneficiaries. In my opinion, both have the opportunity to learn from each other.

In spine, significant concerns exist (e.g., rising costs, declining reimbursement, increasing provider burden) and the outlook is even more bleak given the rapid uptick in spinal surgery demand projected. While increasing volumes will have winners (e.g., implant companies), those fronting the bills and those dependent on delivering that care with seemingly never-ending levels of efficiency are terrified. How can industry help solve the problems that face the field while still creating value? Well, one area may be digital therapeutics.

At the NASS conference, digital therapeutics and other digital health platforms were nowhere to be found. That’s not to say spine and orthopedics industries haven’t invested in digital solutions to date. Companies have started to open their eyes and pursue opportunities to improve and surround surgery with enabling tech. Efforts have focused on moving slightly up-stream in the patient / provider journeys to provide tools like pre-surgical planning, practice workflow management, and slightly downstream solutions like post-op rehab tools. In another way, efforts have focused on defending their turf around surgery. Notably absent at the conference, and in the portfolios of major players, were any truly preventative solutions that may have the potential to curtail the wave of spine surgery demand scaring payers and providers.

Significant value is on the table for innovative companies. There are millions of patients looking for better, safer, more effective options to slow, or even prevent, the progression of debilitating MSK diseases (e.g., back pain, osteoarthritis). There are stakeholders willing to pay for preventative solutions (e.g., employers, IDNs). And now, there are companies beginning to offer solutions targeting this market. To date, it has been the Digital Health firms that have taken the lead in preventative MSK platforms. Notable examples offering holistic solutions for back and joint paint include Hinge Health, Kaia Health, SWORD Health, Digbi Health, Fern Health, and Limber Health, amongst others. MSK players have a lot to learn from DTx companies, not just in how to open new markets through digital solutions and virtual care, but also regarding innovative approaches to drive patient acquisition and build brand awareness.

What can digital therapeutics players learn from MSK? For one, the industry needs to prepare now for a world where competitors are no longer frenemies. The list of players in the space continues to grow by the day and companies that started in dissimilar therapeutics areas are now targeting the same indications. With increased competition, differentiation of solutions and well-honed go-to-market strategies / business models will be vital.

Where Should Digital Therapeutics and Musculoskeletal Players Go from Here?

DTx Companies

- Continue to invest in robust clinical and economic evidence to validate solutions

- Optimize business models along with go-to-market and commercialization strategies

- Be open to collaboration with Spine and MSK companies

Spine and other MSK players

- Be bold in exploring additional value creation opportunities

- Think holistically about the spine and MSK patient journey

- Consider opportunities farther upstream (e.g., interventions, education) to address the market’s needs while also generating brand awareness and creating new patient acquisition funnels

- Work with innovative players to address the industries needs outside of surgery

###

Brandon Wade is a Senior Director at Health Advances with over 9 years of experience in healthcare consulting focused on corporate, franchise, and product strategy, GTM and commercialization strategy, and due diligence. Brandon is the co-Leader of the Health Advances Digital Health and Health IT and Musculoskeletal Committees with years of experience attending major industry conferences in these spaces.