Blog | 8/15/2024

Lots of Robotic Start-Ups Have Arms. But Which Ones Have Legs?

by Tracy Walters and Bridget D'Angelo

Everywhere you look in the MedTech world, someone is developing a new soft tissue robot. And for good reason – big opportunity remains in surgical robotics. Despite exponential growth in recent years, still less than 5% of global procedures are performed robotically, with many applications yet to be robotically enabled. And many facilities, namely ASCs and ex-US hospitals, have yet to adopt robotics. Our recent administrator survey confirmed further investment expectations across settings:

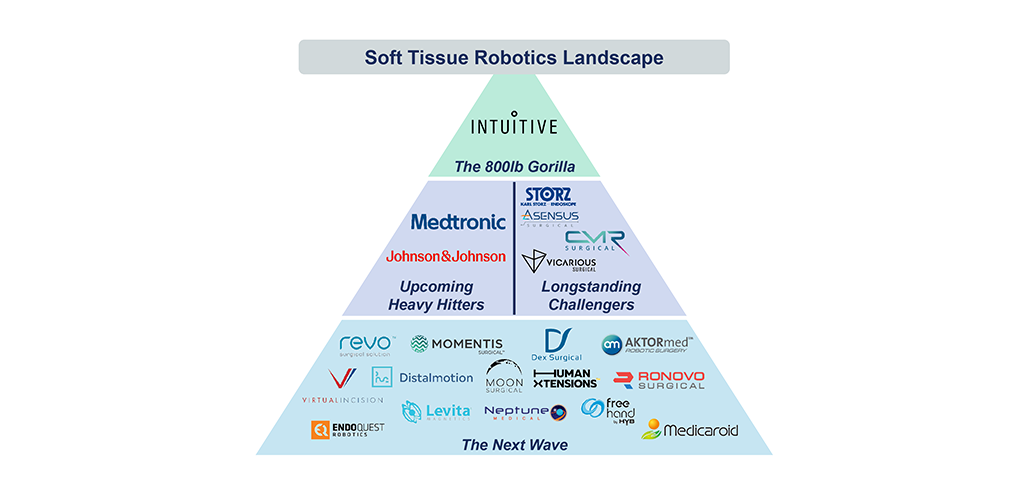

With so much opportunity, it’s no surprise that there are dozens of companies developing robotic systems; we count >20 just in the soft tissue category. Market enthusiasm for robotics continues to be high, with seemingly a new company making headlines each day, but some have notably struggled in recent years. How do we know which ones have potential?

Success (or Lack Thereof) Stories

Intuitive is naturally the biggest success story in robotics today, approaching an installed base of 10,000 da Vinci systems. But that success has taken 20+ years and was driven by factors that competitors cannot necessarily rely on, like a first-to-market advantage and the intangible value of marketing.

Later entrants have encountered even higher adoption hurdles placed by Intuitive. Just look at Asensus Surgical (FKA TransEnterix) – while the company made it to commercialization (a big feat in robotics), and the system has notable clinical and economic advantages, it has still struggled to gain traction and only placed ~8-10 systems per year before being scooped up by Karl Storz (pending deal close). Titan Medical and Medrobotics have both closed up shop in the last two years despite early potential. Others such as CMR Surgical and Vicarious Surgical have gone through recent layoffs as US regulatory timelines get pushed out. In addition to the long development process, asking a hospital that already has da Vinci to switch to or add a relatively unknown system with significant upfront capital cost and a large footprint is simply not a viable strategy.

Medtronic and Johnson & Johnson, however, have a considerable leg up on smaller competitors such as Momentis Surgical and Moon Surgical. They have the scale and breadth to support flexible business models and their presence in laparoscopic instruments bodes well for training and ease of use, in addition to new modular features to save time and space.

Can a Start-up Succeed?

The landscape is fundamentally different than it was years ago when Intuitive’s da Vinci first entered the scene. While it has benefitted from an immense first-mover advantage, followers will need different tactics to succeed. Aside from significant capital for the development process, a successful robotic system must have three key things – demonstrable value, a flexible business model, and a plan for clearing key adoption hurdles in today’s market.

Value

The value of a robotic system can vary by application, but at least one (ideally more) of the following must be demonstrated –

This value should be not just specific to the device’s application, but also to the site of care, which may include multiple facility types. Economic value in a physician-owned ASC will look quite different than in a large hospital system. And an intangible like patient marketing is far more important in applications that are more elective and have not yet established robotics as the standard of care.

Business Model

A successful business model will look different in various settings and applications, as well as different market landscape, e.g., first to market vs. later entrants. But for most products and customers, the sales process will be significantly easier if it does not require a >$1MM capital investment. Leasing has become more commonplace today, especially for large capital equipment, but it comes with tradeoffs – facilities that lease equipment do not have as much motivation to use it and might not be locked in for a long period of time. Companies with broader portfolios have the advantage of being able to offer discounts and volume deals, where facilities pay off the capital over a long contract period through higher priced implants, instruments, or disposables. This model is frequently used with orthopedic robotic systems.

The other key consideration for a business model is facility budgets – capital budgets, while sometimes difficult, are not necessarily beholden to per-procedure reimbursement. Instruments and disposables need to be considered in the context of the total per-procedure cost and relevant reimbursement. So far, robotic procedures cost more than standard ones without additional reimbursement. Any technology and business model that breaks that pattern will be well-positioned.

The flexibility required here is greater if the system can be used in different sites of care. In any case, the model(s) offered should be well-aligned with the needs of the customer just like potential economic value. Often the business model flexibility required to succeed will be far easier for large, established players to execute.

Adoption Ease

Even with value stories and flexible business models, a robotic system can still face significant adoption hurdles, especially in markets already saturated by Intuitive.

These adoption hurdles can be lowered by other factors than the device itself. For untapped applications, especially if physicians are not resistant to new technology, not displacing an existing system can reduce the training and footprint hurdles. These hurdles can also be lowered simply by high volume and/or high growth of the procedures themselves. It’s a lot easier to learn how to use a new system if it’s used frequently and the facility will be more willing to make workflow changes if it’s a top-of-mind (or even better, top revenue generating) procedure.

Conclusion

Some of the start-ups out there right now have some pretty impressive features and remarkable designs. Just a few examples –

- Moon Surgical’s Maestro can hold additional instruments in place to assist surgical staff

- Momentis Surgical’s Anovo robotic control unit only weighs 13 pounds

- Levita Magnetics’ MARS system uses magnets through the skin to reduce necessary incisions

These features sound like meaningful improvements to surgery and to patient care. Will hospitals and ASCs find them compelling enough to adopt in today’s (or tomorrow’s) market?

If you’re looking to commercialize a new robotic system, or consider an investment in robotics, Health Advances can help. Our MedTech team has extensive experience in all things robotics – the procedural applications, the competitive dynamics, hospital/ASC purchasing, and even contract manufacturing of robotic systems’ components.

Health Advances also recently gained the perspective of over 100 hospital and ASC administrators to get a pulse of the industry and understand their expectations for future procedure volume shifts, budgets, and investment. Please reach out if you’re interested in seeing our findings and discussing implications for robotics.