Blog | 2/12/2025

Unlocking Market Potential: The Power of Customer-Focused Segmentation in POC Diagnostics

By Christopher Karras, Vice President, and Donna Hochberg, PhD, Partner and Managing Director

As the diagnostics landscape continues to transform in the post-pandemic era, a customer-focused segmentation strategy is essential for optimal development and impactful commercialization. At its core, segmentation is about recognizing and responding to the diversity of customer needs and preferences. However, traditional market research methods often fall short leaving executives questioning how to exploit untapped market segments and drive growth.

POC diagnostics companies that successfully segment their markets can allocate resources more efficiently across marketing, sales, and R&D, maximizing value for both the customer and the firm. Catering to these distinct segments from the outset by designing products that better align with the specific needs of each group and developing efficient customer-targeting strategies unlocks significant cost savings, drives adoption, and ultimately boosts return on investment.

This blog outlines when and why to use data-driven, customer-focused segmentation to create value for POC diagnostics thereby generating higher revenue and growth while reducing waste in both product design and marketing efforts. Future posts will outline six best practices for overcoming challenges in traditional research methods when segmenting POC diagnostics markets.

Don’t miss the 2 customer-focused questions manufacturers should be asking at every phase in development to ensure market uptake!

When to Implement Customer-Focused Strategy and Segmentation

When in Development Should Segmentation Be Considered?

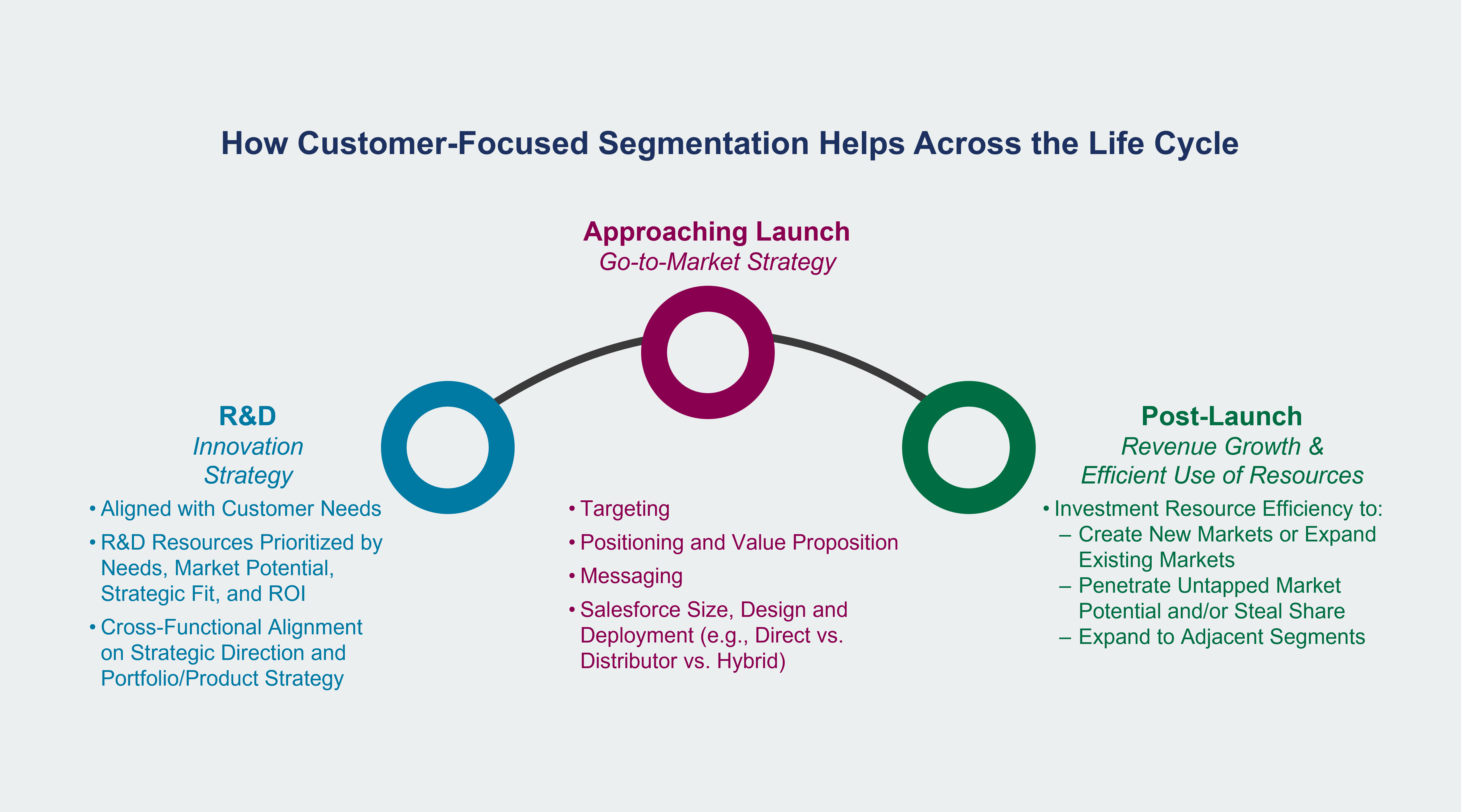

Segmentation allows companies to concentrate their resources on meeting the needs of the most promising segments, ensuring a strong product-market fit - at all stages of the product life cycle.

- Development (R&D): Segmentation helps in designing better products from the outset by understanding the unique needs of various segments. This ensures that R&D efforts are aligned with market needs, increasing the likelihood of product success. Too often, we see copy-cat R&D resource allocation informed by hunches, competitors, or “light” customer research, leading to an undifferentiated product pipeline. From a broader perspective, segmentation is a tool for discovering unmet needs. As companies analyze their potential markets, niches are sometimes uncovered that are overlooked. These discoveries not only benefit patients but also the firm’s perception as an innovator.

- Approaching Launch (Strategic Marketing): As products near market launch, value propositions, messaging, and market prep activities can be tailored to and focused on specific target segments, which improves the odds of evaluation, trial, and adoption.

- Post-Launch (Sales and Marketing): For tests already FDA-cleared in the market, segmentation enhances economic efficiency by concentrating resources where they are most likely to yield returns. This improves efficiency and impact because we know from an opportunity cost perspective, every dollar spent targeting the wrong audience is a dollar that could have been used more effectively elsewhere. Targeting the right segments with the right messaging can lead to margin expansion and value creation.

A good example of successful POC segmentation and product expansion is Abbott's i-STAT system:

- Development: The i-STAT system was developed with features that added significant value in the emergency setting. It provides rapid, accurate, lab-quality results with portability that enabled it to be used directly within the patient care pathway, all of which are crucial in emergency situations where every second counts.

- Approaching Launch: Messaging for the i-STAT focused on how the platform adds value for ER stakeholders. For example, “Streamlines the complexity”, “Drives consistent, high-quality care and patient experience”, “Optimizes workflow and resource utilization”, “Reduces the overall cost of care” – messages that all hit on key clinical, economic, workflow drivers important to these acute care customers.

- Post-Launch: Initially focused on EDs, ICUs, and ORs, Abbott expanded its market by developing tailored test panels for new use cases. Over time, the i-STAT moved into physician offices, rural clinics, and even veterinary medicine. This strategic market expansion demonstrates how understanding and addressing the specific needs of different segments can significantly broaden a product's market footprint and drive sales growth.

Why is Customer-Focused Segmentation So Critical for POC products in 2025?

With the pandemic behind us and as we look to the future, utilization of professional point of care testing, at-home self-collection, and over-the-counter self-testing will continue to expand, driven by decentralization of care, consumerization, technological improvements, and a need to reduce lab strain. New opportunities to creatively unlock market potential are seemingly everywhere:

- New POC diagnostic settings: public awareness of diagnostic testing is at an all-time high post-pandemic and will continue to fuel testing in a wide variety of settings, including physician offices, retail clinics, community health clinics, universities and schools, and the home, among others.

- New segmentation variables: If POC manufacturers limit targeting to historically traditional segmentation variables like care setting or practice size, they may miss a market opportunity. A research and data-driven approach considering clinical, workflow, and economic needs/reimbursement considerations (e.g., capitation in urgent care) enhances the probability of finding a good product-market fit that ultimately leads to test adoption. Relatively new dimensions are worthwhile considerations too. Health systems, for example, are important to consider because they encompass a diverse range of care settings – hospitals, outpatient clinics, and urgent care centers – offering numerous opportunities for device placement. Additionally, health systems often manage large patient populations and have centralized buying processes, making them high-value accounts capable of driving significant volume and growth. It’s possible that your competitors might see the same things you do. But even if they do, interpretations of the same set of observations often differ wildly and therein lies a source of value creation. Noticing and understanding something others don’t see or are unable to respond to provides proprietary insight and potential competitive advantage.

- Competitive Landscape: To survive in the competitive POC diagnostics market, it’s essential to carve out a distinct niche rather than competing on common ground. Differentiation through specialized products, unique technology, or tailored solutions that address customer pain points can help build a strong competitive advantage. Attempting to follow leaders with me-too products often leads to market positions that are not defensible and generally low margin and low growth. Focusing on a well-defined need or an underserved or ignored segment can help position your company for sustainable success.

Two Questions to Ask at Each Phase of Development to Ensure Market Success:

- POC manufacturers need to proactively address any implementation barriers by understanding how their product will fit into the current workflow. For example, a test designed for use by highly trained lab technicians might not be suitable for a clinic where the current workflow is performed by staff with less specialized training. Ease of use, turnaround time, instrument footprint (if test is not disposable), and suitability for CLIA-waiver are just some of many workflow considerations.

- In addition, to drive uptake, novel diagnostic tests will need to add either clinical or economic value to the deciding stakeholders. Each segment-test-technology combination has a set of unique needs, pain points, and willingness to pay, among other decision-making criteria.

- POC manufacturers can find synergies by focusing on the most attractive segments where their company already has a strong competitive position and can efficiently access customers with little incremental investment.

Below is an example of the types of questions a POC manufacturer should ask to develop a winning development and commercialization plan that will identify and target the right segments and drive market uptake:

In the diagnostics industry, a lack of robust data sources or the presence of unreliable data can severely hinder strategic marketing efforts. Standalone diagnostic data sources have historically been ill-equipped to identify market and customer opportunities. For example, just knowing the size of a clinical practice is hard enough to come by, but even if you can find that data, it’s certainly not the only piece of the puzzle you need to know. Without accurate, timely insights into market trends, customer needs, and product performance, marketers struggle to make informed decisions, leading to missed opportunities and ineffective strategies.

Health Advances has proven solutions that overcome these hurdles and has supported a broad array of diagnostics companies – from large multinationals to emerging startups – in identifying POC (and lab) growth segments by deeply understanding the current testing practices and unique customer needs. Our custom approach provides proprietary looks by integrating input from a broad array of potential customers, other external stakeholders such as KOLs and payers, and internal Dx company executives along with robust analysis of secondary data (e.g., claims, Health Advances Proprietary POC Technology Database, etc.) to add rigor to the overall analytical effort and boosting the likelihood of making sound investment and resource allocation decisions.

Overall, customer-focused segmentation is a powerful tool for POC manufacturers. Segmentation is not just a marketing tactic – it’s a strategic imperative grounded in economic logic. By understanding the heterogeneity of markets and allocating resources accordingly, value is created more effectively. For POC executives, the challenge is to use data, research, and creativity to define segments and craft tailored strategies that resonate with each. In doing so, not only will the firm’s performance be optimized but it will also contribute to a more innovative and efficient marketplace for POC firms and their patients.

Sign up here to make sure you receive notice of our next blog on diagnostic segmentation, where we will dig into our Top 6 Best Practices in POC Customer Segmentation.