Blog | 3/24/2020

e-Health in France: Spotlight on the National Healthcare Digitalization Strategy

|

By Dr. Claudia Graeve, Vice President (Health Advances GmbH) |

|---|

|

Summary

|

Background

With a higher than European average spending of 11.5% of GDP on healthcare and good health outcomes, France has been regularly lauded for the high quality of healthcare provided1. Yet, the country has often been perceived as a laggard in digitalization of the healthcare system.

Building on successive digital health policy efforts since 2010, France has significantly sharpened its focus to result in today’s global vision for a comprehensive national e-Health agenda, which puts the patient at the centre. The ‘National Health Strategy 2022’, which was enacted as law in mid-2019, promotes, among other non-digital measures, the reinforcement of governance, security, and interoperability as well as the accelerated roll-out of digital health applications. It aims to stimulate innovation in digital care provision, notably telemedicine, and is supported by an investment program for increasing the digital readiness of the country’s hospital network.

Reinforcing Governance, Security, and Interoperability

Driven by the desire for closer coordination of all stakeholders, both public and private, a single ministerial delegation will take charge of all e-Health activities within the Ministry of Health. In addition, the national digital health agency (ANS) was created in December 2019 from its predecessor agency ASIP Santé to operationalize the government’s e-health strategy. In February 2020, the ANS published the overarching technical policy framework for the e-health services and platforms foreseen by the new legislation. This comprehensive framework will serve as a basis for subsequent enforcement ordinances by the ministry.

In particular, the ANS mission includes the continuation of the development and dissemination of frameworks for security and interoperability of health information systems. Since no standards from the interoperability framework have yet been completely enforced, facilitation of interoperability in EHR systems through a standardized language and coding for all providers and stakeholders remains a key priority.

Accelerate the Roll-out of Digital Health Applications

Focus on Electronic Health Records and Secure Data Utilization through E-health Platforms

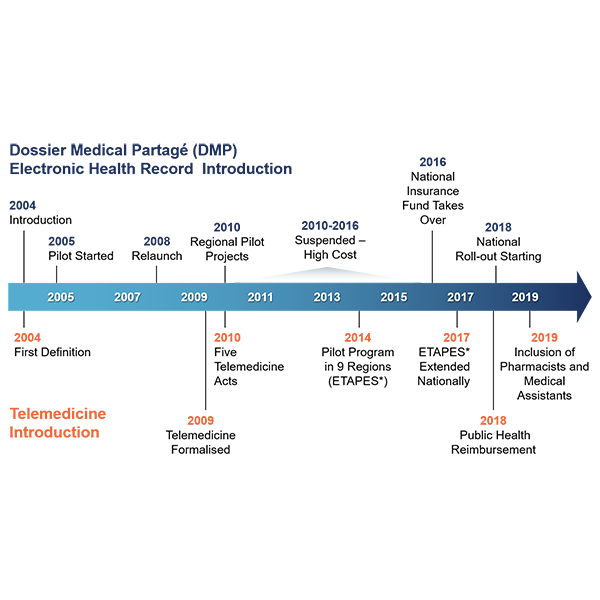

At the forefront of all initiatives is the long-awaited ‘Dossier Medical Partagé’ [DMP], a fully interoperable Electronic Medical Record for all French residents covered by health insurance. After several setbacks, the nationwide DMP roll-out has officially been ongoing since 2018 (see Figure 1).

Figure 1: Timeline of EHR and Telemedicine Introduction in France

DMP = Dossier Medical Partagé, Electronic Health Record

The DMP will be further developed with patient summaries, and vaccination information is set to become integrated this year. Patients exert a high degree of control over their data in the DMP, which is foreseen to become an integral part of the ‘Espace Numerique de Santé’, a digital health platform for patients planned for 2022, and of another planned platform for healthcare professionals, the "Bouquet des Services."

The new law includes the creation of a nationwide data platform called ‘Health Data Hub’ [HDH] which is set up to facilitate healthcare big data sharing and exploitation in high-level security conditions.

Big Data Sharing for Innovation in AI

The aim of the HDH is to foster development of Artificial Intelligence [AI] projects in the health field, which was identified as a priority domain by the French government. The HDH will concentrate and enrich the available French healthcare data, notably the SNDS [Système Nationale des Donnés de Santé] with additional EHR and other data. SNDS is the National Health Data System created in 2015 from the national anonymous claim database, the diagnosis-related group database and the national death registry. With about 66 million covered lives (98.8% of the French population), SNDS is one of the world’s largest continuous homogeneous claim database. 20 pilot projects with academic and private industry partners have so far been selected for their utility on ‘public interest.’

In addition, the plan foresees the development of several key services such as e-prescription and secure messaging and electronic post service, MSSanté (see Figure 2).

Figure 2: High-level Timeline of Planned Roll-out of Key Services and Platforms[/caption]

Foster Innovation in Healthcare Provision and Health Information Technology

Continued Investment into Hospital Information Systems

The DMP implementation today remains patchy and no automated synchronization mechanisms have been established between local patient records in hospitals and medical practices. The investment program ‘HOP’EN’ (which is the continuation of the predecessor program ‘Hôpital Numerique’) aims to foster the modernization of hospital information systems, strengthen the use of the DMP and coordination between hospitals and treating physicians, as well as further harmonize the IT infrastructure of hospitals in a given region.

Promote Telemedicine

France recognizes five types of telemedicine acts, three patient-provider interactions, and two provider-provider interactions:

- Teleconsultation, allows a medical professional to provide a remote consultation to a patient

- Telemonitoring, allows medical professionals to remotely interpret data necessary for the medical follow-up of a patient and, if necessary, adjust care plans

- Medical triage, where the patient is directed to the appropriate care setting when suffering from urgent symptoms

- Teleexpertise, allows the healthcare professional to solicit advice from other healthcare professionals remotely

- Teleassistance, where a healthcare professional assists another healthcare professional remotely in the provision of care

Telemedicine dates back to 2004 when first defined by law in France. After a slow start and several pilots with dedicated funding and reimbursement, teleconsultation and teleexpertise have become available for standard reimbursement through the public health system in September 2018 (see Figure 1). In its first full year of availability, only about 60,000 teleconsultations have been offered to about 30,000 patients, portraying a slower uptake than initially expected, but with signs for further acceleration of uptake.

The new law from 2019 foresees the expansion of telemedicine to include pharmacists and medical assistants. It also authorizes nurses to provide telecare.

| Outlook |

|---|

|

The reimbursement of telemedicine by the public healthcare system has opened the market for software and telemedicine platform players, who have previously addressed the significantly smaller market of complementary private insurers. In this growing market, opportunities exist for established foreign players to enter the French market as well as for start-ups to position themselves with new technology and services. As an example, Teladoc Health, global leader in virtual care based in the United States, acquired the French telemedicine provider MédecinDirect, which provides it with a strong local presence. This leaves the company well placed to tap into the positive market environment and to offer its broad portfolio of virtual care services to a well-established footprint. French startup Doctolib has grown into a leading online appointment platform in France. Having started with a scheduling service for health practitioners, the company has more recently expanded to serve hospitals. With a strong footprint in its home market, the start-up is expanding internationally. The French cloud and software player Cegedim illustrates yet another example for the increased participation in the growing telemedicine market. It acquired the online appointment platform RDVmédicaux and operates telemedicine platform Docavenue. In addition, the clear focus on developing competencies in AI as a competitive advantage internationally offers ample opportunities for health start-ups developing AI solutions. Paris and Strassbourg, in particular, have morphed into the French hubs for AI. With significant emphasis on digital health in the national strategy, France is sending clear signals of aiming to take advantage of emerging technologies and capitalize on the opportunities provided by the digital transformation. This, in turn, will unlock possibilities for manufacturers and service providers with innovative, digital health solutions. |

###

REFERENCES

[1] Goujard, A. (2018), "France: improving the efficiency of the health-care system", OECD Economics Department Working Papers, No. 1455, OECD Publishing, Paris, https://doi.org/10.1787/09e92b30-en

[2] Ministère des Solidarités et de la Santé

[3] ANS - Agence du Numérique en Santé

[4] CNAM – Caisse Nationale d’Assurance Maladie