Blog | 5/6/2020

The Changing Fortunes of Telemedicine in Europe – Past, Present, and Future beyond COVID-19

|

By Greg Chittim, Vice President, Anastasios Pappas, Consultant, and Justyna Bomba, Analyst |

|---|

- Local readiness in Europe for telemedicine service delivery varies widely

- Public reimbursement is the most important foundational element for unhampered telemedicine growth

- COVID-19 is acting as a trigger for a sharp uptake of teleconsultations across European countries

- Countries that have established telemedicine ecosystems in place (public reimbursement, mature regulatory landscape and governance among others) are more likely to maintain this uptake permanently beyond COVID-19

- Pharma companies will benefit if they engage with telemedicine platforms to improve continuity of care and cost-effectiveness

- MedTech companies will benefit if they explore integration options of their medical devices with telemedicine platforms

|

|

|---|

Background

It is official. COVID-19 is wreaking havoc on conventional wisdom. It is a truism to say that we are living through unprecedented times, but in a period where large and established democracies feel they must deny citizens the fundamental right of free movement to address the COVID-19 pandemic, it should come as no surprise that healthcare systems are responding in equally unparalleled ways. Until now, telemedicine was seen primarily as a threat to the revenues and systemic power that hospitals rely on in the larger healthcare system. Now those with the strongest telemedicine capabilities are those most likely to survive the current crises. We have previously described the slow uptake of telemedicine by healthcare systems around the globe; current news headlines cite record growth rates of this service daily. What is here to stay and what will fade away when COVID-19 is no longer the news of the day? What are the implications for biopharma and medical device companies in European countries?

Increased use of technology, as well as regulatory, policy and strategy frameworks are foundational building blocks for telemedicine service delivery

For the first time in human history, we can be reasonably assured that patients across the developed world have access to the basic required technology for telemedicine applications – i.e., access to the internet, a camera and microphone, a big enough screen and speakers/headphones. Although technology is the essential foundation for telemedicine applications, and a solved problem for many, it is not enough.

In order to provide an environment that is conducive to the widespread delivery of teleconsultations and other telemedicine applications, several other elements must be in place. These include (1) a clearly defined regulatory environment creating certainty, safety and security for telemedicine services and (2) treatment of health data as well as medical liability. It includes (3) policies governing the establishment and consumption of telemedicine services, and (4) strategies at national or regional level that provide a vision, role of and pathway to telemedicine within the broader healthcare context. These vary widely between countries in Europe as Figure £1 shows.

Figure £1: Readiness of Various European Countries towards Telemedicine Growth

[caption id="attachment_1853" align="aligncenter" width="1960"]

Source: Health Advances analysis, OECD 2018, ASIP Sante 2019, JASEHN 2017.[/caption]

Among the key gaps to highlight is the lack of a clear medical liability regime for telemedicine at the European level. Cross-border application of telemedicine in the European Union (EU) remains hampered by the implication of different jurisdictions, and healthcare professionals must comply with the requirements of their own jurisdiction, not the patients’.

Public reimbursement stands out as the most important foundational element for telemedicine service delivery

Surveys and country interviews consistently highlight funding and reimbursement as the most important element that needs to be in place for unhampered telemedicine delivery. This goes hand in hand with the importance of the existence of a single coherent governance, management and funding strategy.

Concerns about over-consumption of both healthcare resources as well as drugs, such as antibiotics, are emerging concerns for HCPs as well as governments’ funding public healthcare systems as the quote from Jean-Paul Hamon, President of the French Doctors' Association [FMF] illustrates: “Health care is a serious thing and reliable treatments cannot be traded for the comfort of consultations from a couch. Telemedicine must be used with more judgment and authorities must make sure it’s not spreading into a business.”

Since telemedicine forms part of the wider e-health approach, countries with more mature digital health or e-Health readiness generally offer more favorable conditions.

Figure £2: Foundations for Building a Successful Telemedicine Ecosystem

[caption id="attachment_1854" align="aligncenter" width="1457"]

Source: Health Advances analysis, OECD 2018.[/caption]

A burgeoning teleconsultation platform market with key regional differences

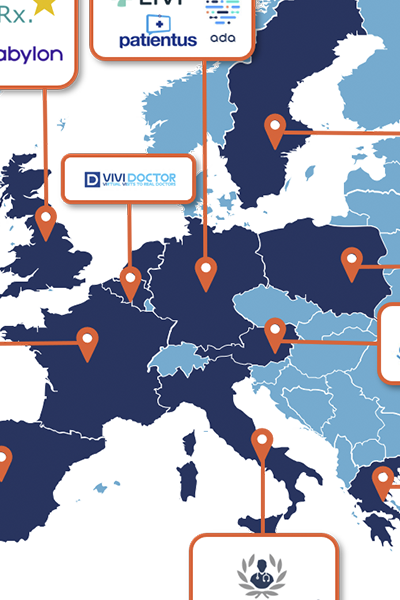

The resulting European landscape for teleconsultation platform companies serves as a litmus test for the telemedicine environments created in each country. Established countries, like Sweden, the UK, and France are seeing healthy competition between platform providers and are attracting additional start-ups into their markets as Figure £3 shows. In countries in the developing or initial stages, there is less choice of teleconsultation providers, yet the current pandemic crisis is inducing market entry by additional players, both domestically and from other countries.

Figure £3: European Teleconsultation Platforms in 2020

[caption id="attachment_1855" align="aligncenter" width="1346"]

Note: Swedish platform KRY has expanded in France and Germany under the name Livi.

Source: Health Advances analysis, CBCN, The New York Times, TechCrunch, Sanita Digitale.[/caption]

Sharp uptake of teleconsultations due to the COVID-19 pandemic

Since the beginning of the pandemic, European countries have not been immune to the overarching trend toward teleconsultations. The restrictions on free movement and travel, the limitation of medical services to emergency situations, and the overall increase in suspected and confirmed COVID-19 infections have all contributed to the recent surge in teleconsultation platforms:

- KRY has seen demand for teleconsultations double

- The demand for Top Doctors in Italy, Spain and the UK has multiplied by 30

- accuRx built a video chat tool in one weekend in March that is now being used in 35,000 consultations a day.

France sees explosion of teleconsultations

The experience in France exemplifies the dramatic explosion in teleconsultation services (see Figure £4). In pre-COVID-19 times, the national insurance fund recorded and reimbursed about 40,000 teleconsultations per month, a figure that has been surpassed by more than 10-fold in one week during the pandemic. A significant number of alleviations have been put in place to break down barriers to virtual medical service:

- The need to know the patient before teleconsultation has been waived for suspected COVID-19 patients

- For patients with COVID-19, the principles of continuity of care have been waived

- All teleconsultations are 100% reimbursed by the national insurance fund, Assurance Maladie (AM) until April 30th

- HCPs may use all and any technical means to conduct teleconsultations, including consumer applications such as Skype, WhatsApp, Facetime, etc.

- Complex consultations are reimbursed at the same level as in-person consultations

- Telemonitoring of COVID-19 patients can be performed by nurses and is 100% reimbursed by AM

Figure £4: Uptake of Teleconsultations in France Before and During COVID-19

[caption id="attachment_1856" align="aligncenter" width="1886"]

Source: Health Advances analysis, Assurance Maladie 2020, Bloomberg 2020.[/caption]

The future of telemedicine relates to its past

Established stage countries are well positioned to retain more of the gains made recently and to see continued growth in telemedicine, given that the environmental factors are conducive to ongoing service delivery. Countries in the developing stage category might experience the current surge as a trigger that pushes the topic of e-health in general and of telemedicine in particular up in the national healthcare agenda. Yet, it will be essential for public health systems to engage in policy work quickly.

Countries at the initial stage will need to bolster their efforts significantly to ensure that the current rise in services is converted to lasting advances. The current experience of both patients and HCPs provides a fertile ground for formalization of telemedicine offering.

Figure £5: COVID-19 Impact on Telemedicine Adoption in EU Countries

[caption id="attachment_1857" align="aligncenter" width="1438"]

Source: Health Advances analysis.[/caption]

Pharmaceutical companies will build a broader menu of service offerings and sustain relationships between brands and patients across the care continuum

An increase in telemedicine across countries in Europe, which are all characterized by large public health systems, will drive biopharma and medical technology manufacturers to rethink their offerings.

Telemedicine can improve continuity of care. Pharmaceutical companies are therefore well placed to bolster their offerings with services that further enhance the continuity of care. These connected solutions could range from high-tech solutions (e.g., Proteus Health’s ingestible sensor technology) to lower-tech solutions (e.g., adherence management applications). Highly prevalent chronic diseases such as diabetes provide numerous examples of new players that are emerging with new competencies in providing support between episodes of care. Austrian company MySugr, for example, provides coaching services to people with diabetes. Pharma companies will benefit from investing into sustained relationships in time and over the patient’s evolution of the disease, rather than focusing on transactional relationships or prescription volume alone.

Telemedicine shows potential to improve the cost-effectiveness of care including supporting HCPs to improve resource utilization as well as patient-centric support to improve health outcomes. Additional service models are emerging that cater to improving the quality of teleconsultations by data collection of medical history and making these available for the virtual visit itself – an area that is largely untapped by pharma companies but has started to see an influx of new players from the broader IT sector.

Medical Device manufacturers will explore “smart” devices for integration into teleconsultations

One of the main challenges with teleconsultations is the obvious absence of a physical examination. This constitutes an unmet need that medical device manufacturers with at-home use devices can aim to address. Connecting digitalized versions of devices such as examination cameras, stethoscopes, otoscopes, ECGs, and spirometers to teleconsultation services can enhance the diagnostic and therapeutic value of the teleconsultation session significantly.

StethoMe, a smart Stethoscope that enables patients to self-examine early respiratory issues and send the data to their HCP, is one example of this device category. The company announced last month, during the height of the pandemic, an agreement to integrate their stethoscope platform with two teleconsultation platforms through a versatile API - MaQuestion Medical in France and HomeDoctor in Spain. The quote from Juan Lariz, CEO of HomeDoctor, sheds light on the rationale for the agreement: “As a company providing telemedicine services, we want to increase the efficiency and effectiveness of our services. Adding the ability to perform remote lung examinations supported by AI is a very important functionality - and in the case of the COVID-19 epidemic is crucial. We’re excited to work closely with StethoMe.”

Conclusion

Industry participants have a unique opportunity to shape the future of healthcare. Governments across Europe are being confronted with the adequacy and resilience of their healthcare systems. Together, all market participants need to unite in their desire to leave us better placed to withstand the next health crisis – for the benefit of all.

###

| About Health Advances European Practice |

|---|

|

Health Advances European Practice helps clients navigate through the diversity of European healthcare systems to optimize commercialization strategies of pipeline and in-market products. Should you be interested in understanding opportunities in Europe, please contact us at HAEurope@healthadvances.com. |

| About the Authors |

|---|

|

Greg Chittim co-leads the Health Advances Health IT and Digital Health practice, with sector expertise in population health management, electronic health records, interoperability, pharmacy technology, clinical communications, connected medical devices, virtual and home care, real world evidence, and data monetization. Anastasios Pappas leads project teams in the European Practice of Health Advances in Zug, Switzerland. Anastasios is experienced in market access and reimbursement of drugs, medical devices, and digital health in various disease areas in EU5 and in the US, as well as in economic impact analysis and pricing. Justyna Bomba is based in the European Practice of Health Advances in Zug, Switzerland. Justyna is experienced in market and competitive landscape assessment for several therapeutic areas across pharma, diagnostics and medical devices. Special thanks to Dr. Claudia Graeve for her significant contributions to this article. |

REFERENCES

[1] OECD 2018

[2] ASIP Sante 2019

[3] JASEHN 2017

[4] Assurance Maladie 2020

[5] The New York Times 2020

[6] TechCrunch 2020

[7] Sanita Digitale, 2020

[8] Businesswire 2020

[9] Bloomberg 2020

[10] European Commission 2018