Blog | 12/4/2019

Australian Biotechs and Medtechs: Look to the East

| By Andrew Briggs, Engagement Manager |

|---|

|

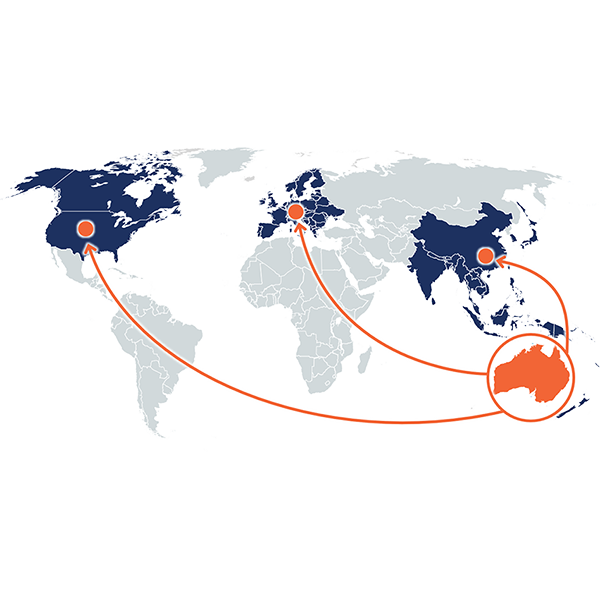

Australian biotechnology and medical technology companies have historically prioritized the West (US and Europe) as the initial major market(s) to launch new products. However, the tide may be turning. A few notable examples of Australian device companies prioritizing the East for commercial focus, combined with some positive trends for market access in China could signify a broader shift of Australian health-tech companies putting earlier emphasis on launching products in China ahead of the West. The next blog in this two-part series will focus on critical factors for ensuring success in the Chinese market. |

Historic Preference for the West

Australian health technology companies have tended to develop products with the goal of initially launching in Western markets due to a number of reasons:

- Well-defined development and regulatory pathways

- Large market size(s) compared to other geographies

- Relatively attractive pricing compared to other geographies

- Similar healthcare systems to Australia and demographically comparable patient populations (for clinical suitability of products)

- Shared English language with the West

- Resonance with US-based investors

Despite these factors pushing companies to look to the West, globalization and other evolving healthcare dynamics continue to increase the attractiveness of the East as a market for health tech products. A few recent examples highlight this shift to initially prioritize the East for healthcare technologies instead of the West.

Examples of Prioritizing the East

In June of 2018, Australia-based Sirtex Medical – a microsphere radiation therapy specialist – rebuffed an acquisition bid from the world-leading radiotherapy company Varian Medical Systems. Instead of choosing an ostensibly ideal strategic partner in Varian, the Sirtex board selected a consortium of Chinese investors to take the company private. Both Sirtex and the Chinese-based investment groups cited the potential to introduce Sirtex’s chief product in China as a key rationale (in addition to a higher value bid) for choosing the Chinese investors over Varian.

Another one of Australia’s life science innovators anticipates focusing commercialization of its pioneering technology exclusively in the Asia-Pacific region due to the large and growing relevant patient population in China and Southeast Asia. The iQ Group very publicly touts the APAC region as the target market of choice for its novel Saliva Glucose Biosensor, while continuing to further develop the underlying sensor technology for other chronic conditions at the University of Newcastle, Australia where the product was initially pioneered.

Trends Making the East Commercially Viable Early in the Launch Sequence

The decisions of Sirtex and iQ Group to prioritize the East demonstrate that the region can be a viable initial market for novel biotechnology and medical technology products. Additional ongoing trends may serve to further close the gap between the East and West.

|

Trends Favoring the East |

Impact and Examples |

|

|

Improving Regulatory Environment, Particularly in China |

➔ |

Lowers the barrier for innovative solutions to enter the market

|

|

Aging Population in China and Fast-Growing ASEAN Population |

➔ |

Creates greater unmet need for innovative health technologies to address increasing disease incidences/prevalences

|

|

Greater Interaction Between Australian and Chinese HealthTech Companies |

➔ |

Fosters collaboration and bi-directional flow of ideas, technologies, and industry experts

|

|

Chinese Investment in Australian Healthcare Sector |

➔ |

Increases focus on launching products in China and allows Chinese investors to help Australian companies enter China |

Despite these favorable trends, a few commercial headwinds remain. Concerns around intellectual property security, the ability to attain favorable product pricing, and choosing to develop local sales and distribution capabilities vs. utilizing a partner may discourage Australian companies from prioritizing the East. Nevertheless, the aforementioned trends are expected to drive more Australian Biotechs and Medtechs to consider the Asian market, and China specifically, as a high priority region to launch new products. Stay tuned for Part II of this series – “Critical Success Factors for Product Adoption in China” coming in 2020.

###

| About Health Advances |

|---|

|

Health Advances is a healthcare-focused strategy consulting firm that works with health technology companies and investors to evaluate and execute commercial opportunities in Asia and more broadly across the globe. With our recently opened office in Hong Kong, Health Advances is excited to assist Australian and Asian clients commercialize innovative healthcare products in China and beyond. If interested, please contact one of the members of our Asia Markets Practice Management Team at HAAsiaMarkets@healthadvances.com. |

| About the Author |

|---|

|

Andrew Briggs is an Engagement Manager based in Health Advances’ Hong Kong office, leading teams to develop growth strategies and conduct commercial due diligence for medical device, biopharma, and investor clients. |