Commercial Diligence

Take due diligence deeper with data-driven, rigorously quantified assessments that help you gain a realistic picture from a trusted partner, spot synergies others miss, and prepare to drive upside long before the deal is finalized.

How We Help

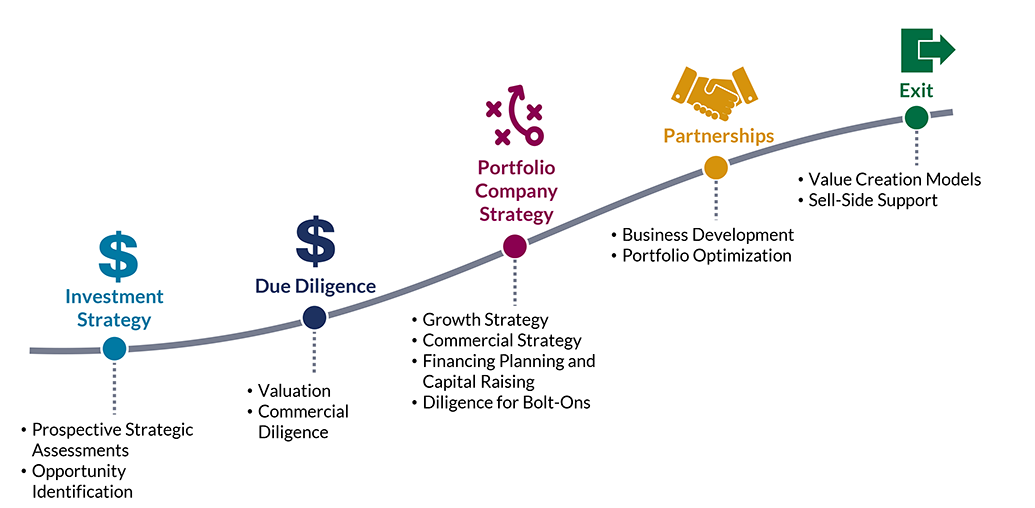

Clients rely on Health Advances’ robust valuations to confidently make critical business decisions and gain external validation to support partnering negotiations. Health Advances is one of the preeminent strategic advisors to healthcare-focused investment firms and strategics throughout the investment life cycle – from buy-side to sell-side.

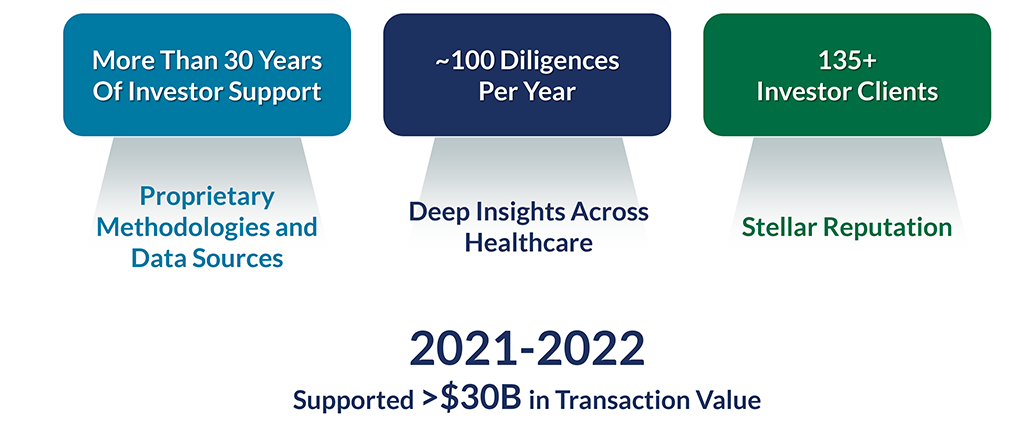

Health Advances Strategic Investor Support

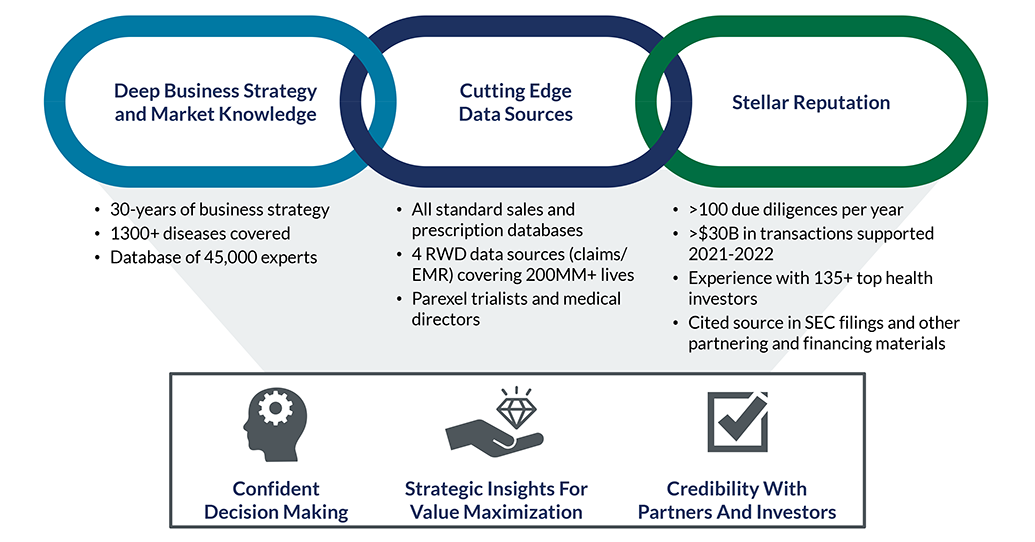

Our Advantage

We are uniquely positioned to execute diligence and valuation projects across sectors with a stellar reputation and investor network, cutting edge insights, and deep ties to the strategy.

We are uniquely positioned to execute diligence projects across sectors. Our robust assessments enabled >$30B in investment from 2021-2022.

Clients rely on Health Advances’ forecasts and valuations for critical insights and external validation.

Impact

- Deep insights that identify issues early

- Robustly quantified assessment to negotiate opportunities with a clear path to ROI

- Strategic insights to drive upside

Health Advances supported an early-stage company in the cell regeneration space to prepare an investor presentation. Our team worked closely with the client to articulate the value proposition behind its technology, key differentiation from competitive platforms, and the development path to value inflection points. The client used our evaluation directly in discussions with potential investors.

small biotech with a cancer vaccine and T-cell therapy came to Health Advances for a forecast and business plan in support of its application to be listed on a major stock exchange. The client needed assistance detailing the market context, revenue, clinical costs, and commercialization costs forecasts for its assets. The Health Advances team did deep dives into the epidemiology of each disease, the distribution of patients across lines of therapy, and the oncology market across the US, Europe and Asia. The team synthesized these data into models and detailed documents to be submitted to the stock exchange regulatory body, which allowed our client to highlight its value and facilitated its inclusion on the stock exchange.

Health Advances conducted a detailed evaluation of the US market opportunity for a major NIPT laboratory for a private equity client. Our team assessed the payer coverage policies, reimbursement rates, and pricing trends for NIPT across risk segments and evaluated the increasingly complex competitive landscape to forecast the overall US NIPT market over 5 years, as well as the specific offerings of the Target. Based on this assessment, our team made recommendations to our private equity client on whether to pursue this investment, as well as outlined a strategic approach that would best position the Target for success.

Health Advances was engaged to perform an assessment of the market potential for a novel instrument for the clinical diagnostics laboratory and to assist our clients in determining if this product was a sound investment. Interviews were conducted with laboratorians to determine the potential impact this technology would have on the efficiency and workflow setup in their laboratories as well as to uncover any potential clinical impact. In addition, several hospital laboratories were visited to quantitatively assess the current workflow and technician time spent on specific tasks, assay turnaround time, space needed to accommodate various lab instruments and to gather cost data for instruments and reagents. Data collected from these site visits fed directly into an interactive model used to assess economic and FTE savings due to the implementation of this novel instrument. This tool enabled our client to change assumptions around time savings from use of the instrument and pricing (instrument and reagents) to determine what price point will provide the most compelling argument for potential customers while still garnering a significant return for the company.

A diagnostic manufacturer wanted to identify adjacencies to pursue through M&A. Our team first developed a long list of potential adjacencies based on call point alignment and supported by lab director interviews. After shortening the list with the client, we prioritized adjacencies looking at market outlook, strategic fit, and ease of executing M&A. Our team delineated an M&A roadmap to build up the portfolio, which motivated our client to engage with targets and perform further diligence.

A leading global diagnostics company engaged Health Advances to assess the market opportunity for a company providing novel lab tests for breast and metastatic cancers. Health Advances spoke with a range of physicians and payers, and conducted a survey of oncologists, to understand the need for these tests both now and in the future, awareness of these tests, and methods to improve adoption. Health Advances then characterized which patients are most likely to receive these tests by stage of cancer, comorbidities, patient preferences, and the results of initial gene expression assays. The team also evaluated existing guidelines and considerations around reimbursement. From these analyses, Health Advances identified target test users, and quantified the impact of conducting clinical trials on these tests. The team characterized the highest potential growth opportunities for future development and provided a go/no-go recommendation on moving forward with the acquisition, along with identifying potential bolt-on acquisitions.

The leadership of a global molecular diagnostics company wanted to understand the importance of acquiring a US CLIA commercial lab to complement their current instrument and consumable portfolio. Our team evaluated the criticality of lab acquisition through interviews with both industry experts and clinicians, detailed competitor analog analysis, and review of the evolving molecular technology landscape. We then conducted diligence on potential targets to evaluate whether these labs would be the right players to acquire to enhance our client's overall mission and business. Our resulting recommendations anchored our client's decision to initiate formal diligence talks with target management.Life Science Research Tools – Buy-Side Diligence: A global healthcare holding company engaged Health Advances to conduct due diligence on a company offering a range of microscopy solutions. Our team conducted in-depth secondary research and spoke with a diverse group of experts and microscopy users across life science research organizations, clinical labs, and applied markets. We explored Target's business outlook including evolving microscopy use cases and competitive positioning in each market segment across the US, EU3, and Asia. The research resulted in a robust five-year growth projection, a total addressable microscopy market size by segment, and a go-/no-go recommendation on investment.

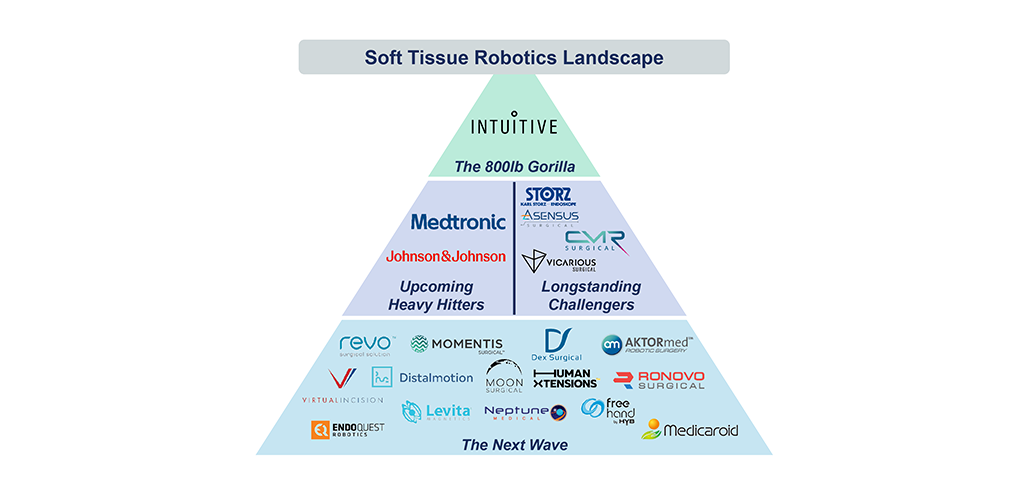

A PE client engaged Health Advances to assess the investment opportunity in a manufacturer of disposable surgical instruments and supplies in the areas of ophthalmology, ENT, robotic surgery, and gynecology. As part of the engagement, Health Advances evaluated the company’s major revenue drivers, growth in surgical procedures where the products are most applicable, recognition and perception of the brand against competing brands, and potential risks to continued growth. Health Advances assessed the demand for surgical essentials and end market landscape in each key clinical area, supported by an in-depth interview program involving clinicians, purchasing administrators, and biomedical engineers. Our team synthesized this information to provide our client strategic recommendations regarding the potential acquisition of the target.

Investors in an established medical device manufacturer engaged Health Advances to evaluate a potential acquisition Target by assessing the outlook for the Target's key markets and its positioning in those markets. The Health Advances team conducted in-depth interviews with clinicians and purchasing administrators, a quantitative survey of clinicians, and detailed triangulation of secondary sources to inform the outlook for the markets and the Target. Key considerations for the market included procedure growth trends and drivers, site of care and reimbursement dynamics, the impact of new technologies, and the state of KOL opinion and clinical literature. Additionally, the team characterized the competitive landscape and the Target's positioning within it, including purchasing dynamics, pipeline products, and pricing trends. The work ultimately informed the client's decision to move forward with the diligence process.Investors in an established medical device manufacturer engaged Health Advances to evaluate a potential acquisition Target by assessing the outlook for the Target's key markets and its positioning in those markets. The Health Advances team conducted in-depth interviews with clinicians and purchasing administrators, a quantitative survey of clinicians, and detailed triangulation of secondary sources to inform the outlook for the markets and the Target. Key considerations for the market included procedure growth trends and drivers, site of care and reimbursement dynamics, the impact of new technologies, and the state of KOL opinion and clinical literature. Additionally, the team characterized the competitive landscape and the Target's positioning within it, including purchasing dynamics, pipeline products, and pricing trends. The work ultimately informed the client's decision to move forward with the diligence process.

Our client asked Health Advances to evaluate the potential of a single-use product used during robotic and laparoscopic surgeries and the ability to support its commercially with an inside sales and marketing strategy. Our team gained insights to understand the perceived value of the product by speaking with both users and non-users of the product and conducting surveys with surgeons and OR administrators. This allowed the team to both understand the need for the product and the level of sales support required in order to introduce the product to physicians and facilitate adoption. These insights empowered the client to decide on a potential acquisition and validated the degree of sales and marketing effort required to support the product.

Health Advances conduced a sell-side due diligence for a third-party independent service organization that provides holistic maintenance and repair services for a wide range of biomedical and diagnostic imaging equipment. Health Advances created a compelling sell-side deck, highlighting key market trends, a large and serviceable addressable market, as well as the client's own commercial successes and customer reputation in comparison to its key competitors. Our team further contextualized potential future opportunities for the client in expanding contracts to a full-service healthcare technology management and integrating adjacent technology services.

As part of broader strategic support, Health Advances was asked by a private equity client and their portfolio company to evaluate a potential acquisition in the mindfulness space to support the client's existing digital health platform focused on weight loss and chronic condition management. Health Advances used primary research with HR Benefit executives and insurance brokers to understand the competitive landscape and customer unmet needs. The findings were synthesized into recommendations that aided in making an acquisition offer as well as a strategic roadmap to integrate the two products to maximize value.

A biopharma client engaged Health Advances to support a buy-side due diligence on a digital therapeutic to complement the client’s drug offering. Specifically, the client was interested in the optimal go to market strategy for a DTx in Germany given regulatory changes. The team conducted a deep dive into the DiGA pathway to quantify the pricing potential, benchmark cost for customer acquisition and retention, and specify the adoption potential through targeted secondary-research-based analog research. We synthesized our findings in a comprehensive report detailing investment requirements to successfully launch a DTx in Germany.