Corporate Strategy

Strategy is about making the hard choices that give your company the focus necessary to achieve a sustainable competitive advantage.

How We Help

Our teams regularly tackle the toughest strategic questions facing innovators at the corporate, franchise, and asset levels.

Our fit-for-purpose approach to corporate strategy is highly customized to your strengths and aspirations and the intricacies of your product and market positioning. We partner with you and your cross-functional teams to build alignment on strategic plans that chart future market developments, define winning positions, and outline critical investments and initiatives to unlock sales growth.

We drive a highly collaborative strategy process to align on initiatives and investments to differentiate your business and drive growth.

Our Advantage

We have deep knowledge of numerous end markets to accurately understand a company’s position and help you align on informed choices that mitigate challenges and achieve the ideal future state.

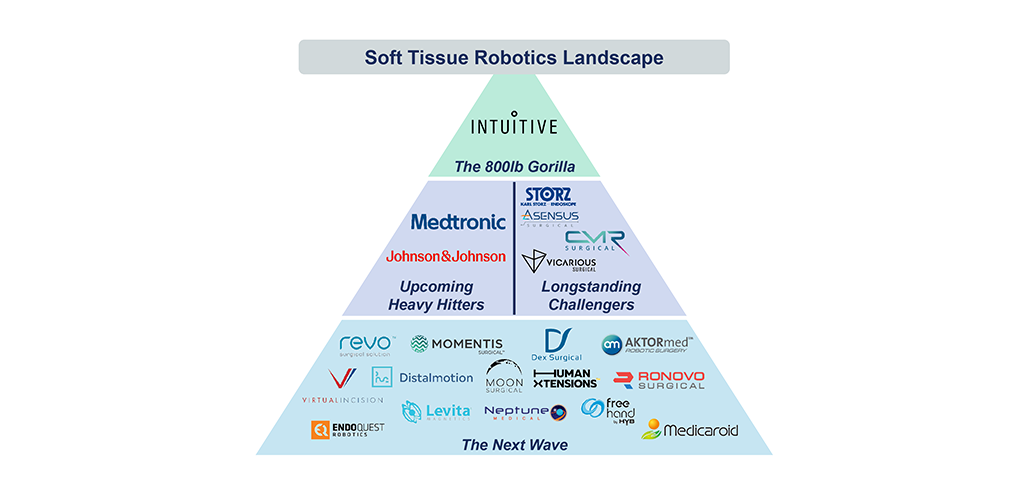

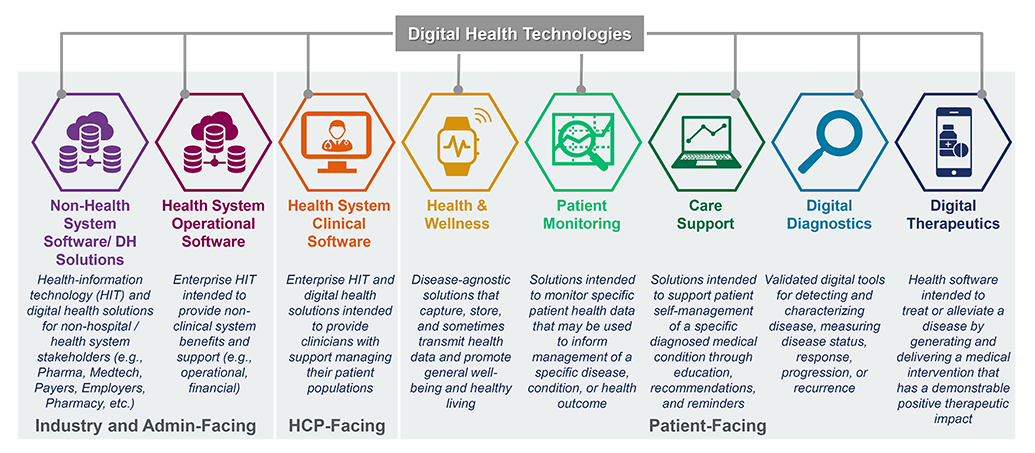

Our consultants bring unique depth that spans the clinical and market intersections of biopharma, medtech, diagnostics, and digital health. From this strategic vantage point, we identify the best internal and external opportunities for you to translate innovation into commercial advantage.

Impact

- Systematic approach to focus efforts on value-creating investments

- Previously unseen opportunities to grow your business

- Decades of experience guiding management teams toward sound strategies that excite and inspire action across functions

As it prepared to commercialize its first product and build out its cardiac franchise, a mid-sized pharma company asked Health Advances to develop a portfolio strategy. We fostered internal, cross-functional alignment on recommended disease areas to prioritize. We developed strategic frameworks that could be leveraged by the company to evaluate new disease area opportunities over time. The client used the findings to drive R&D investments and define its near-term strategic plan.

Health Advances was engaged by a venture-backed, clinical-stage biopharma with a data-science platform in the CNS space to develop a corporate strategy. We worked closely with the management team to perform a situation analysis, identify key market and competitive trends, and develop a decision tree to inform portfolio priorities in different scenarios. Our work provided a vision for how the company could create value and underpinned the strategic guidance that management provided to investors, leading to a successful financing round.

Working with the executive team of a multi-billion dollar diagnostics company, Health Advances led a board-mandated review of the strategic positioning and business options for the company. In addition to a thorough assessment of internal strengths and weaknesses of each division within the company, we also examined the competitive environment, trends with customers, our client’s position and the options for expanding the business internally and through acquisition.

A leading multinational diagnostics firm engaged Health Advances to assess the impact of changing healthcare delivery models on its portfolio and implications for its long-term corporate strategy. Through in-depth primary and secondary research, the team assessed the evolution of care delivery settings, reimbursement models, and diagnostic technology over the next twenty years in the US, France, and Germany. Using these insights, the team articulated the testing solutions needed for the future and quantified anticipated testing volume for key clinical disciplines by both setting and technology. These analyses formed the basis for development of an optimized long-term strategic roadmap defining attractive R&D and M&A opportunities for the client to meet future customer needs and drive market disruption.

A biopharmaceutical company with a strong pipeline of targeted therapeutics engaged Health Advances to understand best practices of structuring a precision medicine team. Our team conducted extensive internal interviews, interviews with industry experts, and built detailed profiles of precision medicine teams at established biopharmaceutical companies to inform our recommendations on how to structure the team in both the near and long term. Recommendations were developed based on the unique size and composition of the client's precision medicine portfolio.

Health Advances was engaged by a global provider of tools, equipment, and materials used for life science research and bioprocessing, to define its strategy for its bioprocessing division over the next 10 years. We spoke with 50 bioprocessing experts globally representing familiarity with all therapeutic modalities, company sizes, and stages of development to inform our findings and strategy recommendations. Our team evaluated the full biologics pipeline by modality, development phase, sponsor size, and geography, and projected the 5-year growth in the pipeline to determine the areas that would experience the highest growth and be high value targets for bioprocessing product offerings. We then performed a deep dive into key trends impacting bioprocessing, including the growing use of process analytical technology, digitalization, and continuous bioprocessing, and incorporated these trends into recommendations for product and service offerings and capabilities. We synthesized our research and co-developed a full 10-year strategy for our client, touching on key areas and end users to target, products and capabilities that would require development, the timeline for these activities, and how the client should ultimately position itself in the evolving future state of bioprocessing.

A global life sciences company providing a suite of specialized clinical chemistry analyzers retained Health Advances to develop its five-year growth strategy for the clinical diagnostic and bioproduction markets. Our team pursued in-depth discussions with bioproduction industry experts and clinical lab directors from multiple geographies to develop a deeper understanding of customer needs, the competitive landscape, and adjacent product areas. We developed a global strategy for serving the bioproduction and clinical lab markets including identification of key product features, high priority customer targets, and assessment of adjacent clinical lab instruments across both US and ex-US markets. Our final deliverable included a five-year strategic roadmap outlining individual growth initiatives in the bioproduction and clinical lab markets and a seven-year revenue projection of the bioproduction growth opportunities.

Faced with increasing global competition for its diabetes business, our client engaged us to develop a turnaround strategy to drive business growth. We collaborated closely with local client teams in Europe and Asia to examine business challenges, and we conducted in-field research with local physicians, budget holders, and industry experts to diagnose market pressures and identify leverage points for our client. After developing strategies based on these evaluations, we then estimated the financial implications of different initiatives. We provided recommendations to drive sustainable growth in the short- and long-term and gained internal alignment on the strategy.

A contract manufacturer asked Health Advances to assess and prioritize potential avenues for new growth across three broad clinical areas: biopsy, neuromodulation, and vascular access. The team further segmented these clinical areas in 16 end-markets, assessing market size, growth, competitive landscape and clinical trends for each. Primary interviews with clinician users were used to further assess trends and brainstorm growth opportunities. Ultimately, the team recommended that the client focus on diversifying its customer base in 4 categories, expand into 5 new end-markets, and develop complementary kit components in 2 more. The client's commercial team directly used the final deliverable to target and structure conversations with OEM customers.

Health Advances was engaged by a leading drug delivery OEM to refresh their view of the on-body (wearable) drug delivery market and inform their future investment strategy. Our team characterized the relevant market trends, customer segments, competitive landscape, sales cycle, and partnership structures. We also conducted a detailed pipeline analysis to educate the client on the size and growth of the market and to prioritize specific opportunities that the client could pursue. In-depth interviews with potential biopharma customers and OEM industry experts helped characterize the unmet needs of the industry. At the completion of the engagement, the client gained a thorough understanding of the current and future state of the on-body drug delivery market, clearly defined customer segments and their unmet needs, as well as a list of business development opportunities to monitor going forward.

An enterprise health IT client engaged Health Advances to better understand its core and adjacent markets around health information management, in addition to developing a growth strategy that would ultimately support a capital event. The team conducted both qualitative and quantitative primary research with current and potential customers including HIM directors and health IT executives in US health systems, payers, and long-term care administrators. The team analyzed the company's internal data to showcase the product and service's value through the breadth and volume of data the software can seamlessly ingest. Leveraging this research, Health Advances identified strategic recommendations for ways our client can position itself to drive growth as well as identified new customer segments to target.

Health Advances was engaged be a leading global manufacturer of wound care products to devise a strategy for integrating digital technologies into its chronic care management product portfolio. Through primary research with provider organization executives (i.e., CEOs, CIOs), clinicians, and payers, Health Advances assessed the value proposition of key platform components including but not limited to clinical decision support, automated visual analysis, and remote patient monitoring. Features were evaluated in the context of value-based care and in today's predominantly fee for service environment. In addition, the team synthesized data from over a dozen analogs to identify successful strategies for digital product commercialization. Health Advances synthesized both the primary and secondary analyses to articulate a cohesive strategy for the digital platform that included feature prioritization, viable payment models, and potential partnership opportunities.