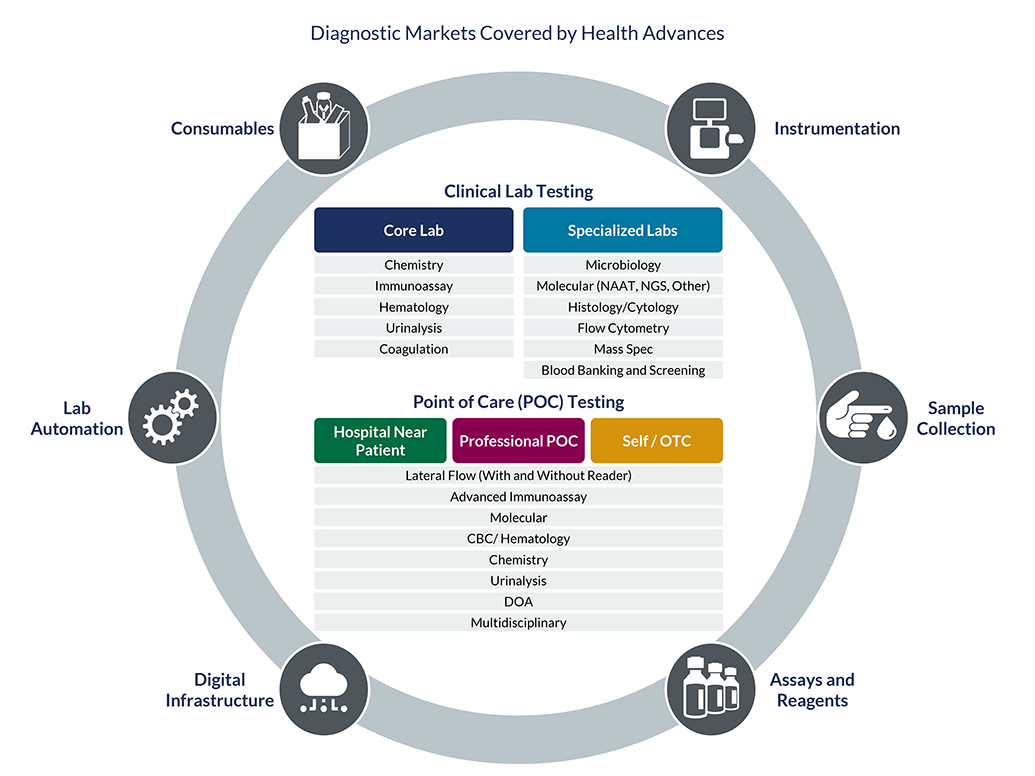

Diagnostics

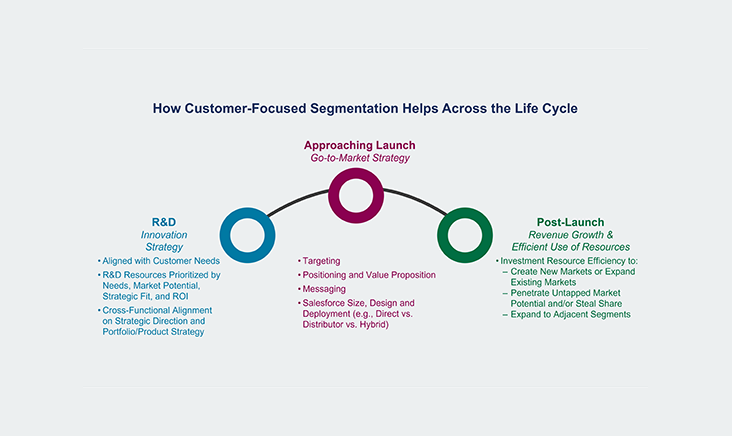

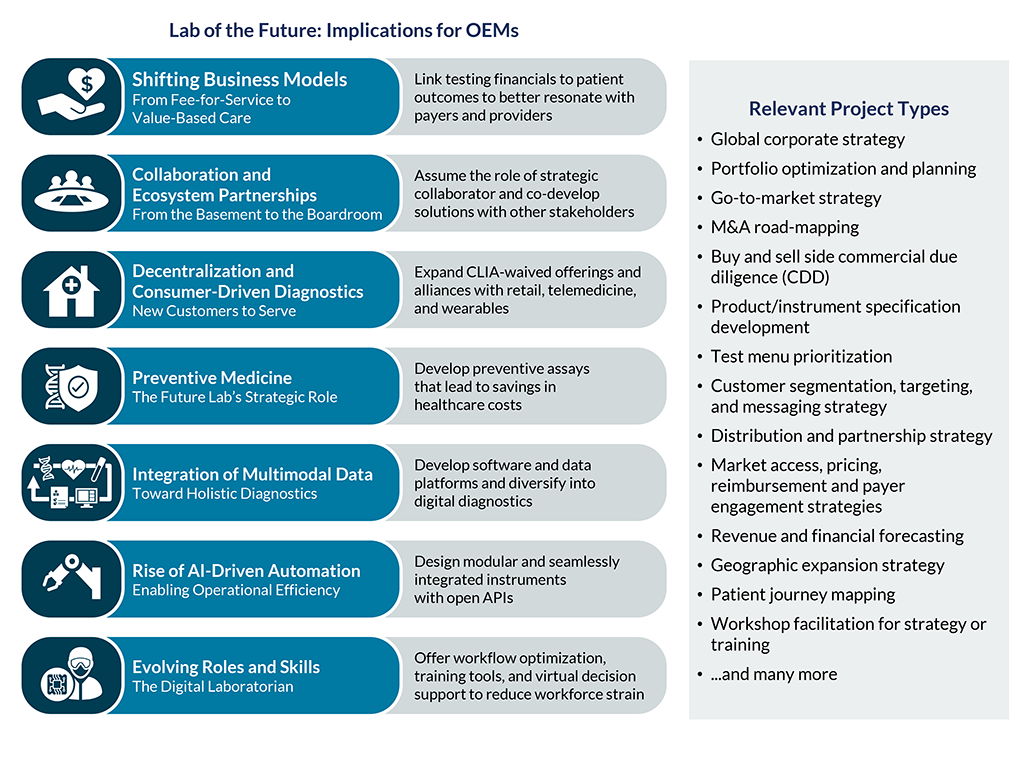

Across all segments of the diagnostics industry and for all technology categories our teams serve as trusted advisors to identify avenues for growth and determine optimal go-to-market strategies for our OEM, lab, and CDMO clients.

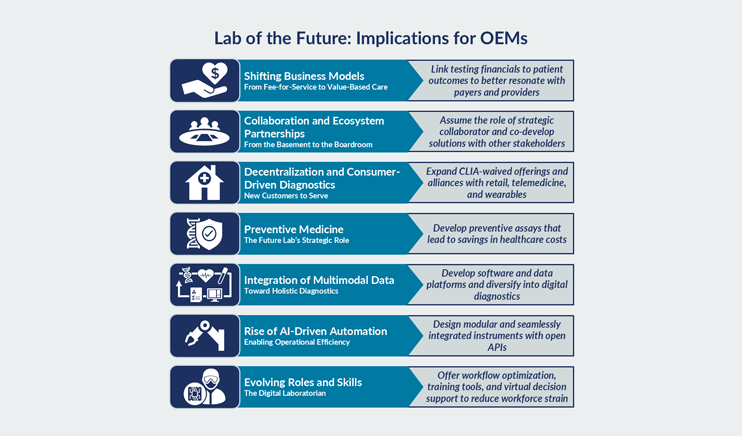

The diagnostics industry is on the precipice of a transformation, driven by a convergence of trends that are intensifying and reshaping the clinical laboratory landscape. While a number of trends have been with us for some time, more significant changes over the next 10-15 years are expected, propelling the clinical lab industry to dramatically evolve the way labs operate. During this pivotal time, a deep understanding of market dynamics and commercialization requirements is essential. Our team helps incumbents and newcomers alike maximize growth by understanding where to focus and how to build a defensible business.

Diagnostics Case Studies

Working with the executive team of a multi-billion dollar diagnostics and life sciences company, our team led a board-mandated review of the strategic positioning and business options for the company. In addition to a thorough assessment of internal strengths and weaknesses, we also examined the competitive environment, customer trends, our clients’ position and the options for expanding the business internally and through acquisition. Areas of investigation included immunoassay, clinical chemistry, hematology, flow cytometry, molecular, and coagulation. This work enable our client to, reinvigoration its strategy and achieve growth goals.

Health Advances was engaged to develop a test menu roadmap for a start-up company’s novel molecular POC diagnostics platform. We screened a broad array of test opportunities, performed an in-depth evaluation of top tests, and prioritized development options based on commercial potential and overall risk. Interviews and a survey of PCPs, Ob-Gyns and a variety of other clinical practice settings, as well as deep secondary research, were used to estimate market sizes, understand major trends, and develop a comprehensive view on each top test. Detailed recommendations on prioritized test menu opportunities, as well as test sequencing were provided as key pillars to the roadmap.

For an emerging core lab diagnostics player, the team analyzed the US hospital and reference lab markets to determine the appropriate customer segmentation and key marketing messages for commercialization of a novel hematology analyzer. Adoption potential across customer segments was evaluated through qualitative interviews and a quantitative survey with hematology lab directors and managers and interviews with hospital purchasing managers. The team created a P&L model with scenarios analysis for different partners, recommended optimal instrument and per test price points, and provided a lab budget impact model demonstrating the clinical and economic benefits of the platform. Ultimately, the work was used to determine the client’s corporate and product strategies and facilitate an acquisition by a global IVD player.

A leading molecular diagnostics company sought to optimize its infectious disease test menu across panel sizes and platforms. For this project, Health Advances evaluated the outlook for syndromic testing in the US for pathogen identification in 5 clinical areas. Our team's research included conducting online quantitative surveys, online focus group discussions, and phone interviews with clinicians and lab directors. In addition, the team calculated the total addressable market in the US by clinical area using both customer-driven and epidemiology-driven methodologies. These analyses culminated in a set of strategic recommendations to support the client's molecular infectious disease test menu roadmap by clinical area and platform.

Our team was tasked with helping a contract design and manufacturing client to develop an optimal growth strategy. Several opportunities were identified as potential options. Our team assessed trends in the need for and use of custom disposables in the development and production of IVD platforms (lab and POC). Interviews with R&D executives at large and small OEMs and with disposables design and manufacturing companies were conducted as well as review of the secondary literature. Ultimately, a strategic recommendation was made on when and how to enter the space.

Health Advances was engaged by a company with a high-sensitivity technology to provide an update to its clinical diagnostics strategy in the CNS space. The team conducted in depth interviews with clinicians, payers, and industry experts and secondary research reviewing clinical literature and industry analogs in order to validate the most attractive scenarios for test menu and entrance into clinical diagnostics. Additionally, the team evaluated analog companies to demonstrate how significant value can be generated for shareholders through clinical diagnostics business models. To complete the work, the team updated the P&L from a previous engagement to provide a financial perspective on the recommended strategy.

Our team worked with an investment group to assess the market outlook for a company with controls and sample storage products used in the clinical diagnostics markets. Revenue projections were generated based on market sizing from secondary research, future drivers and barriers of utilization identified in primary interviews, and potential risks based on future trends in the industry, including the potential for regulatory and OEM relationship challenges.

A global diagnostics leader engaged our team to evaluate entry into the next generation sequencing (NGS) market in select, non-oncology clinical areas. The project assessed market outlook and adoption dynamics across the US and Europe, focusing on platform configuration and test menu, along with barriers and drivers of adoption. Through qualitative interviews and a quantitative survey with conjoint analysis, we identified customer preferences and segmented the market by lab type and expected future NGS utilization. For launch, we defined the optimal NGS platform and test menu, assessed high-level pricing and access requirements, and delivered a strategy spanning customer targeting, platform design, menu development roadmap, and value messaging.

Diagnostics Leadership

Donna Hochberg, PhD

Partner and Managing Director, Head of Dx, PM, and LST & Services

Diagnostics, Precision Medicine, & Life Science Tools & Services InvestorsDiagnostics, Life Science Tools & Services, CNS Diseases, Women's Health