Contract MedTech Services

The Backbone Supporting the MedTech Industry

The world of medical devices, from consumables to implants to capital equipment, only operates smoothly with the help of critical contract MedTech service providers. These behind-the-scenes partners keep the industry moving, and moving forward, with every new wave of innovation and change

At Health Advances, our MedTech practice leaders partner with you to better prioritize opportunities for your contract services business by characterizing the impact of trends across three levels:

- End-market growth drivers and barriers,

- End-market competitive dynamics, and

- Contract service preferences and positioning

End-to-End Expertise

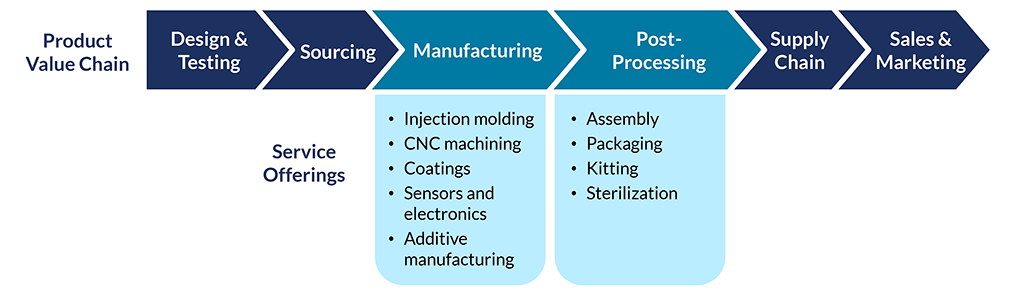

With 30+ years of experience in medical devices, our team has a deep understanding of the many steps and dynamics in the product value chain and the role that service companies play in this process.

We can provide market insights and strategic considerations for everything from niche, single offering specialists to broad, end-to-end partners.

Assess your business in the context of the broader contract services landscape.

Your Markets, Your Customers

There is nothing more powerful than understanding your markets and your customers as a service provider.

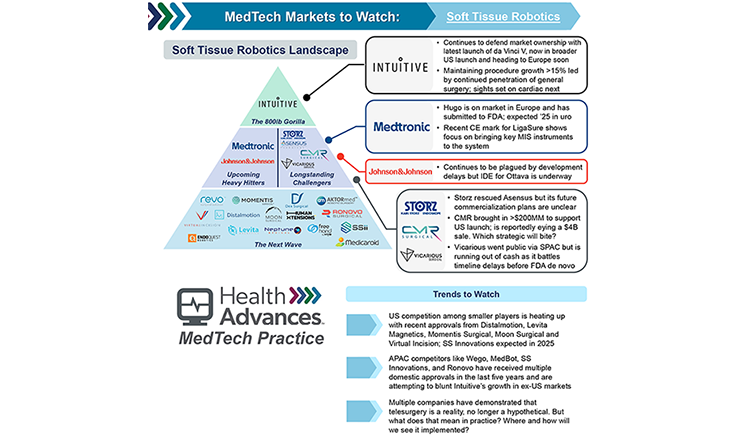

We are experts in gaining nuanced insights on your markets, products, and customers, including:

- Procedure volume growth trends

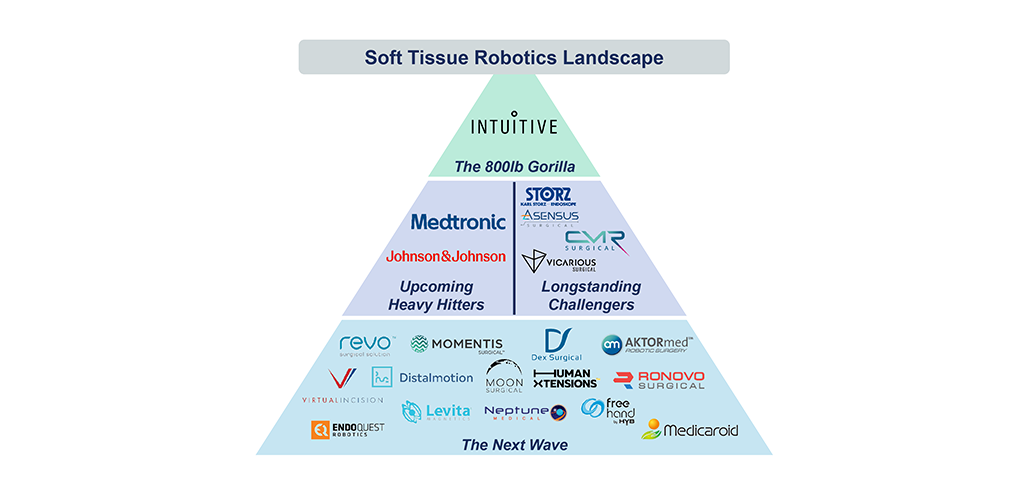

- Impact of product innovations, e.g., robotic approaches

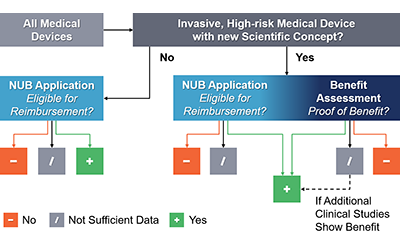

- Shifts to outpatient settings and associated reimbursement changes

- End-market pricing pressure

- Competitive landscape and positioning

- Pipeline threats

- Reputation of service providers

- Stickiness of customer relationships

- Supplier switching costs

- Threat of competitive CMOs

- Room to grow within key OEM accounts

Understand all potential factors impacting the future outlook of your business.

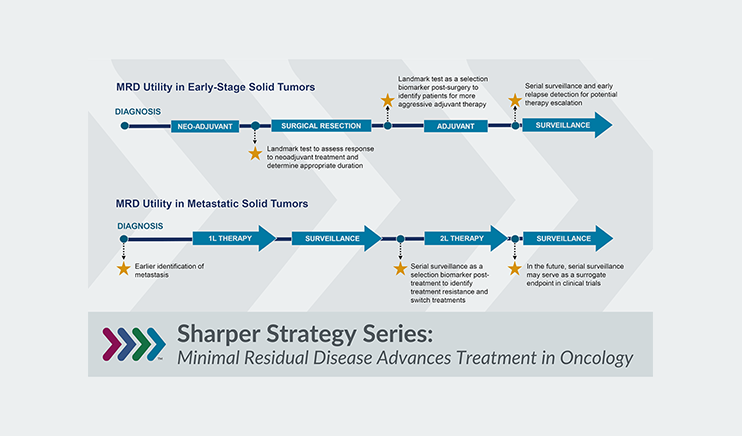

Salient Industry Trends

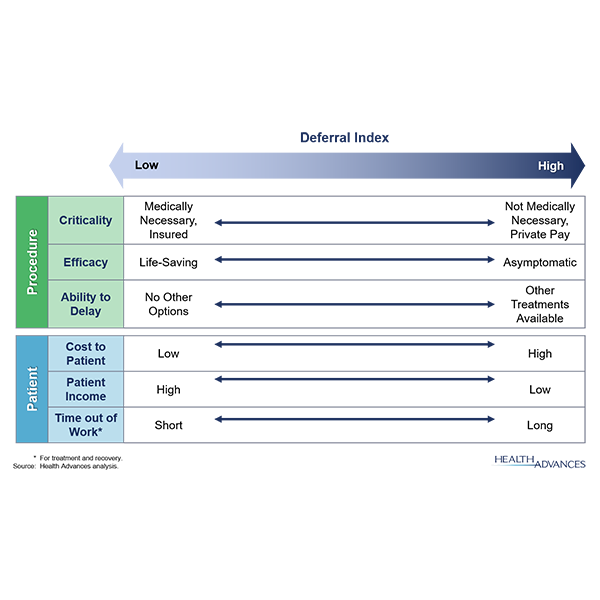

The contract services market is evolving rapidly, and service providers must adapt to continue growing. To name just a few:

- OEMs are looking to outsource more of the value chain so they can concentrate on design, truly novel manufacturing (materials and processes), and sales and marketing

- Significant supply chain disruption in recent years has led OEMs to re-evaluate the need for dual sourcing and more robust risk mitigation

- Heavy M&A activity in contract services has led to broader competitive offerings from single organizations, both horizontally and vertically

Recognize the macro trends impacting contract services so you can stay ahead of the competition.

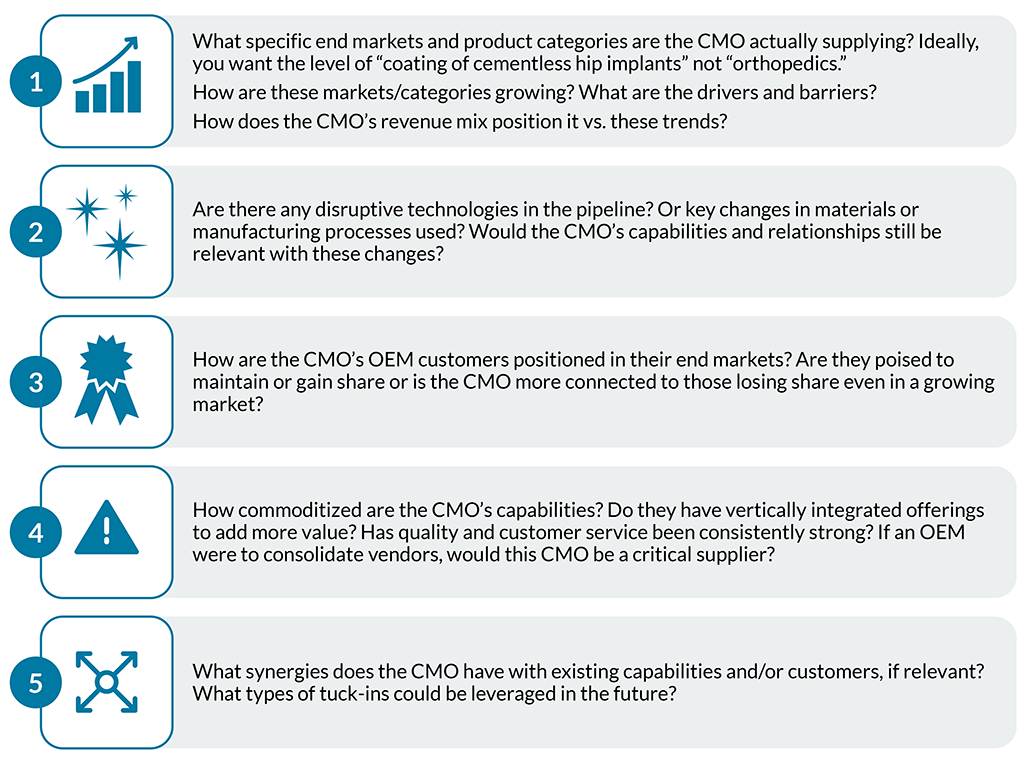

CDMO Contract Service Work: Key Questions

New Opportunities

Contract services are never just about the services themselves. We put the business in the context of the greater medtech continuum of care.

Contract MedTech Services Case Studies

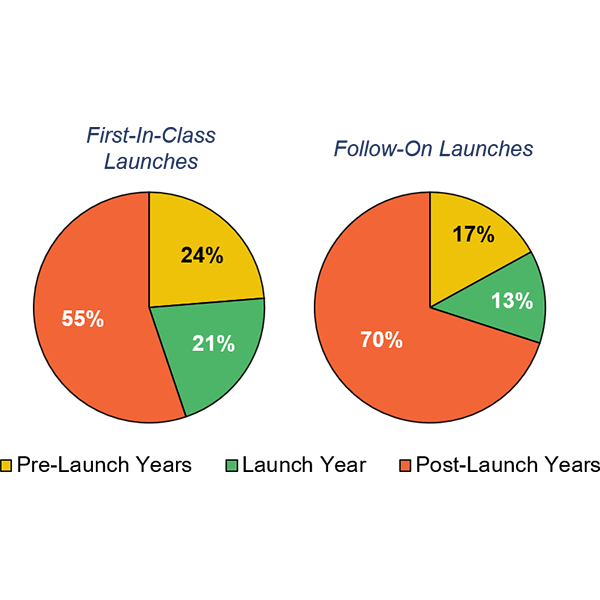

An investor sought to better understand the sales potential and outlook for a US based orthopedic CMO. Our team, with extensive experience in the musculoskeletal and CMO sectors, utilized a multifaceted approach of extensive secondary research of the CMO and end product markets, associated with the team it manufactured as detailed assessment of coating technologies, a robust analysis of internal target data on top programs, and interviews with OEM customer sourcing executives and industry experts to deliver the insights necessary to make the investment decision. By mapping each top program along a product lifecycle curve, we were able to provide insights on the expected revenues and their respective risks. We worked to validate the uniqueness of the target's proprietary technologies, the customer outsourcing trends, and the target's reputation to lend confidence to the final investment decision and acquisition.

Health Advances conducted due diligence on a mid-sized CMO with multiple manufacturing capabilities including machining, injection molding, thermoforming, and device assembly. We analyzed internal capabilities and historic revenue trends coupled with a robust analysis of end market growth and other trends that may impact the potential for the Target over the next 5 years to inform our Client's investment decision. We evaluated the Target's opportunities across both mature end-markets (e.g., surgical capital equipment) and more nascent, rapidly evolving end-markets (e.g., home dialysis equipment). For our Client, we synthesized our findings into a succinct presentation recommending investment in the Target.

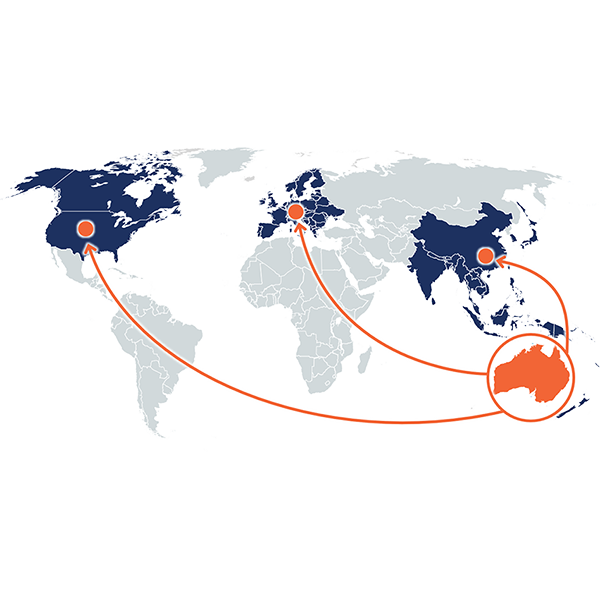

Health Advances performed due diligence on a potential acquisition target providing surgical microscopes and service to a range of medical specialists and practice settings. The team performed secondary research and qualitative and quantitative analyses including a US-based physician survey with ophthalmologists, neurosurgeons, ENT surgeons, and practice administrators to understand the outlook for the target's business. Analyses provided insights into purchasing decision-making, new technology advancements, service contracts, and broader healthcare trends that will impact the 5-year outlook in the US, UK, and Canada. Investment recommendations for the client focused on a strategy that takes into account the different growth opportunities for the target's instruments and service offerings across geographies and practice settings.

Contract MedTech Services Leadership

Tracy Walters

Partner

MedTech InvestorsCapital Equipment, Consumables, Instruments & Supplies, Contract MedTech Services, Contract Pharma Services, DME & Consumer Devices, Implantables & Injectables

Susan A. Posner

Partner and Managing Director, Head of MedTech, Digital Health and HIT

MedTech Digital Health & Enterprise HIT InvestorsCapital Equipment, Consumables, Instruments & Supplies, Contract MedTech Services, Contract Pharma Services, DME & Consumer Devices, Implantables & Injectables, Women's Health