Blog | 4/22/2024

IRA Implications for Rare Disease Drug New Product Planning

By Olivia Foroughi, Health Advances; Doug Mullen, Health Advances; Brian Duda, Parexel; and Carrie Jones, Health Advances

In the few quarters post-IRA passage, we have been bombarded by a plethora of thought pieces, lobbying, and legal battles coming from stakeholders across pharma. CMS negotiating with the manufacturers of the top ten highest spend Medicare Part D drugs while many of the same companies have their day in court does little to quell industry concerns. For executives at rare disease drug developers, there remains uncertainty on how to best manage IRA risk in the context of product strategy. Here we offer a framework to incorporate IRA risk into new product planning.

Context

Historically, rare disease drugs have earned preferential treatment in recognition of the substantial hurdles associated with drug development and commercialization. Unlike development of ‘common’ disease drugs, rare disease drug development presents unique challenges that are fundamentally driven by the small size of the affected population. Clinical trials are complex to design as a clearly defined disease natural history is often lacking. Even with a well-designed study, patients are difficult to recruit due to limited disease awareness, and low rates of diagnosis. Once approved, rare disease therapies often require complex pricing and market access strategies, and must manage uncertainty from ‘skinny label’ competitors. The passage of the US Orphan Drug Act (ODA) nearly forty years ago and other efforts aimed to address these barriers by offering seven years of market exclusivity, accelerated development timelines, comparatively limited trial size, pediatric rare disease vouchers, and financial and tax incentives.

Despite incentives, rare disease drug development still lags other indications, with no approved treatment options for 90% of rare diseases, and a 6% success rate in clinical trials1. The IRA only compounds challenges for manufacturers. While the law exempts single indication orphan-designated drugs from IRA price negotiations, if the product acquires an additional indication, that drug will lose the exception and potentially be subject to Medicare negotiation . There is legislation before the House of Representatives, the ORPHAN Cures Act, that would permit continued negotiation exemption for multi-indication orphan-designated drugs, yet a dwindling Congressional calendar and a Presidential election year provides little comfort to the rare disease industry.

IRA Impact Framework for Rare Disease NPP

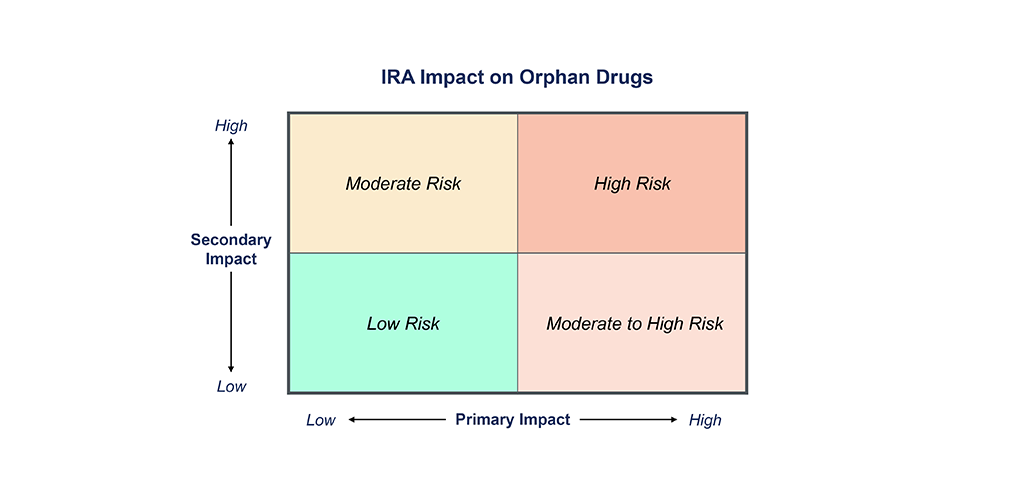

The IRA forces us to reconsider the traditional new product planning playbooks and instead incorporate a more nuanced assessment of IRA risk into decision making regarding indication prioritization, clinical development strategy, and forecasting. Manufacturers should consider both the risk of being subject to IRA negotiations (primary impact) as well as the likelihood of increased pricing and market access pressures from competitor drugs being subject to IRA negotiations (secondary impact). Figure 1 provides a framework to assess the impact of IRA for an orphan drug.

Primary Impact

Assesses the risk of a manufacturer’s drug becoming one of the top 60 drugs by Medicare spend and therefore being subject to IRA price negotiations. This is driven by the annual number of Medicare recipients expected to be on drug at peak and the annual gross sales of the drug. Under the current legislation, any orphan-designated drug with a single indication, or a drug with generic or biosimilar competition, is exempt from IRA negotiations and therefore at lowest risk of a primary impact from IRA.

Secondary Impact

Determining a drug’s likelihood of secondary IRA impact is more complex and considers the likelihood of a competitor product being subject to IRA negotiations and impacting the other competitors in the same indication. Indications with higher levels of competition and payer management are more likely to experience the secondary impact to pricing, for both Medicare Advantage and commercial contracts. The impact of the IRA is likely to extend into Medicare Advantage and commercial payer contracting, as payers will apply additional pressure to manufacturers to offer concessions based on Medicare’s negotiated price. Conversely, a new drug that is expected to be positioned in a later line or provides significant differentiated benefit may be more insulated from the secondary impact.

Outlook for Rare Disease Drugs

The IRA impact will vary wildly across rare disease drugs. The drugs with the greatest risk will be multi-indication, high-cost therapies, with a sizable 65+ patient population, without generic or biosimilar competition, that have the potential to achieve high enough sales to fall on the list of drugs selected for Medicare negotiation . The highest risk drugs will also have secondary impact from competitors within the same indication subject to the IRA. The moderate-high risk category includes those with high Medicare exposure and no generic or biosimilars, but a low indirect impact from another drug in the class subject to IRA negotiation. Drugs with a younger and/or smaller population, lower price, generic or biosimilar competition, and single orphan-designated indication, but still indirectly impacted through competitive IRA pressure, are considered moderate risk. And the lowest risk therapies are those that have a small or under 65 population, one orphan indication, available generics or biosimilars, and have limited exposure to competition likely subject to IRA negotiations. Manufacturers will need to first establish where their product falls on the spectrum before making any IRA-driven strategic decision .

Additional IRA Considerations for Rare Disease Drug NPP

Although the traditional strategy of developing follow-on indications to support life cycle management is no longer a straightforward decision for rare disease drugs, manufacturers should not completely abandon multi-indication plans. Instead, manufacturers at higher risk of IRA impact can consider development strategies that optimize time on market. Rare disease companies can even consider parallel track development options across multiple indications although such a strategy needs to also account for trade-offs in upfront investment, internal bandwidth and execution risk, and managing development risk. NPV modeling can help contextualize these trade-offs and the value potential to inform NPP strategy decision.

Outside of rare disease-specific considerations, manufacturers can consider formulation options, as well as modality selection as biologics enjoy a longer regulatory exclusion than small molecules under the current framework. Launch pricing should be carefully considered to realize maximum value in the first seven to nine years after launch.

Ultimately, NPP teams at rare disease companies will have to thoughtfully consider unique tradeoffs across R&D through lifecycle management to optimize commercial opportunity and patient impact .

Source

https://phrma.org/Blog/Dont-close-the-door-on-rare-disease-research

:::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::

About the Authors

Olivia Foroughi, Consultant and member of the Rare Disease Practice at Health Advances

Doug Mullen, PhD, Vice President and co-leader of the Rare Disease Practice at Health Advances

Brian Duda, Principal in Pricing and Market Access at Parexel

Carrie Jones, Partner and co-leader of the Rare Disease Practice at Health Advances